Best Place To Get A Personal Loan is ideal place to receive a personal loan is determined by your unique financial condition and requirements, although there are numerous popular possibilities to consider. Traditional banks and credit unions frequently provide their members with competitive interest rates and customized attention. On the other hand, online lenders offer ease and a speedy application process, making them a popular alternative for many consumers. Peer-to-peer lending systems match borrowers with individual investors, who may offer more flexible conditions.

Furthermore, if you have strong credit, you may be able to obtain a personal loan with advantageous terms from a respectable financial institution. Finally, the best place to get a personal loan is where you can get the finest terms, such as a reasonable interest rate, manageable payback terms, and good customer support. Before making a selection, it is critical to compare offers from several sources and carefully analyze the terms and conditions.

Why Choose Best Place To Get A Personal Loan?

Choosing the right site to receive a personal loan is critical since it can have a considerable impact on the loan’s terms and conditions, such as the interest rate, repayment terms, and overall cost. Here are some of the reasons why you should think carefully about where to receive a personal loan:

Interest Rates: Personal loan interest rates vary depending on the lender. The best site to get a personal loan will usually have competitive interest rates, which will save you money over the course of the loan.

- Advertisement -

Loan Terms: Loan terms, such as repayment period and repayment schedule flexibility, might differ from lender to lender. A smart lender will provide terms that meet your financial needs and objectives.

Fees and Charges: Pay close attention to any loan fees or charges. The top lenders will have clear charge structures and may even offer loans with no origination or prepayment fees.

Credit Score Requirements: While some lenders have stringent credit score requirements, others are more liberal. Your credit score and financial position will determine where you can acquire a personal loan. If you have an excellent credit score, you may be able to get better conditions on loans.

Loan Amount: Various lenders may have different minimum and maximum loan amounts. Make certain that the lender you chose provides a loan amount that suits your requirements.

Customer Service and Reputation: Consider the lender’s reputation and customer service. Read reviews and get advice from people you trust. A trustworthy lender with good customer service can make borrowing easier.

Traditional Banks vs. Online Lenders: You can select between traditional banks and online lenders. Online lenders frequently provide greater convenience and quicker approval processes, although traditional banks may provide in-person help and a local presence.

Shopping around: Do not settle for the first lender you come across. Compare offers from several lenders to get the one that best fits your financial position and aspirations.

Loans, Secured vs. Unsecured: Determine if you want a secured or unsecured personal loan. Unsecured loans do not normally demand collateral, but secured loans do. Your decision may have an impact on the interest rate and terms.

Here Is List of The Best Place To Get A Personal Loan

- sofi

- Upstart

- LightStream

- Discover® Personal Loans

- Upgrade

- Best Egg

- Happy Money

- LendingClub

- SBI Personal Loan

- Moneyview

- Faircent

- Incred

- KreditBee

- Yes Bank Personal Loan

- Tata Capital Personal Loan

- Shriram Finance Limited

- HDFC Bank Personal Loan

- Fibe Personal Loan

- ICICI Bank Personal Loan

- Bajaj Finserv

- IndusInd Bank Personal Loan

- Kotak Personal Loan

- Standard Chartered Personal Loan

- Cent Personal Loan

- Axis Bank Personal Loan

- Citibank Personal Loan

- Bank of Baroda Personal Loan

- IDFC First Bank Personal Loan

- Canara Bank Personal Loan

- SMFG India Credit

30 Best Place To Get A Personal Loan

1.Sofi (Best Place To Get A Personal Loan)

Sofi is largely recognized as one of the best websites for obtaining a personal loan. SoFi has become a go-to alternative for consumers seeking financial aid due to its reputation for giving affordable interest rates, clear conditions, and great customer care. What distinguishes SoFi is its focus to provide a streamlined online application procedure that allows borrowers to access loans promptly. SoFi offers a variety of loan alternatives to meet your needs, whether you’re trying to consolidate debt, finance a large purchase, or cover unforeseen expenses.

Furthermore, SoFi’s exclusive member advantages, such as career coaching and networking events, can provide value beyond the loan itself. When you choose SoFi for a personal loan, you gain access to not only a dependable financial partner, but also a helpful community to assist you in reaching your financial objectives.

2.Upstart

For a variety of reasons, Upstart is largely recognized as one of the best sites to obtain a personal loan. What distinguishes Upstart is its revolutionary approach to lending, which employs cutting-edge technology and data analysis to evaluate candidates. This approach allows Upstart to consider more than just standard credit scores when assessing a borrower’s creditworthiness, giving persons with limited credit history a fair opportunity. Furthermore, Upstart provides reasonable interest rates, flexible lending terms, and a quick and simple application process.

Their commitment to transparency ensures that borrowers understand the conditions of their loans, making it an ideal choice for people seeking financial flexibility and convenience. Upstart is a prominent alternative for consumers looking to satisfy their financial demands because of its solid reputation for providing dependable and fast personal loans.

3.LightStream (Best Place To Get A Personal Loan)

LightStream is without a doubt one of the greatest locations to get a personal loan. LightStream has earned the trust of countless borrowers looking for financial solutions because to its reputation for openness and low prices. LightStream distinguishes itself by offering low-interest loans with no fees or prepayment penalties, making it an appealing alternative for individuals wishing to save money on borrowing costs. Their short and straightforward online application process provides a prompt response, and if granted, monies can be transferred in your account as soon as the next day.

Furthermore, LightStream provides a diverse range of loan options, from debt consolidation to home repair, making it adaptable to a variety of financial demands. Whether you have great or good credit, LightStream is an ideal solution for consumers looking for personal loans with advantageous terms and a hassle-free borrowing experience.

4.Discover® Personal Loans

Discover® Personal Loans is, without a question, one of the greatest sites to get a personal loan. Discover has a strong history of financial excellence and consumer happiness, and it provides a smooth and transparent borrowing experience. Their personal loans include low interest rates, flexible payback options, and no origination costs, making them an appealing option for people in need of financial assistance.

What distinguishes Discover is their dedication to customer service and desire to work with individuals to discover the loan that best meets their needs. Discover’s Personal Loans provide a trustworthy and effective solution for your financial goals, whether you’re consolidating debt, funding a home improvement project, or covering unforeseen expenses.

5.Upgrade (Best Place To Get A Personal Loan)

If you need a personal loan, updating your options for obtaining one is critical, and there is no better place to do so than at Upgrade. Because of its focus to delivering affordable rates, flexible terms, and a simple online application procedure, Upgrade stands out as one of the finest locations to receive a personal loan. Upgrade offers a variety of loan alternatives geared to your unique needs, whether you’re trying to consolidate debt, support a home improvement project, or pay unforeseen expenses.

Upgrade ensures that the loan application process is both efficient and stress-free by providing a user-friendly platform, speedy approval, and transparent terms. Furthermore, their commitment to client happiness and financial wellbeing is unparalleled, making it the perfect choice for people looking for a personal loan. Upgrade can help you upgrade your financial journey right now.

6.Best Egg

Best Egg is a well-established online lending company with a great reputation for providing personal loans to consumers in need of financial assistance. Best Egg, with a focus to simplicity and efficiency, offers a simple application process, making it simple for individuals to obtain the funds they require. The platform provides affordable interest rates and a variety of lending options to meet a variety of financial demands, including debt consolidation and home renovation projects.

Best Egg’s commitment to customer service and track record of timely fund delivery make it a popular choice for individuals looking for a dependable and convenient lending solution. Best Egg is a trusted name in the area of personal loans, whether you’re wanting to reach your financial objectives or face unexpected bills.

7.Happy Money (Best Place To Get A Personal Loan)

When you need financial assistance, Happy Money is the ideal location to receive a personal loan. Happy Money stands apart in the field of personal loans due to their customer-centric approach and commitment to making the borrowing procedure as simple and transparent as possible. They provide reasonable interest rates, flexible payback options, and a simple online application process that guarantees swift approval and money.

What distinguishes Happy Money is their commitment to assuring their customers’ financial well-being and happiness, with the goal of fostering a positive connection with money. Whether you need a personal loan for debt consolidation, home improvement, or any other reason, Happy Money is the place to go for friendly financial assistance.

8.LendingClub

LendingClub is largely regarded as one of the best sites for obtaining a personal loan. LendingClub has continually earned the trust of borrowers seeking financial aid thanks to its user-friendly online platform, affordable interest rates, and a reputation for openness and reliability. Their peer-to-peer lending strategy connects borrowers with private investors, providing a fresh take on personal loans.

The application process at LendingClub is simple, and they provide a variety of loan options, making it accessible to a wide range of borrowers, whether you need funds for debt consolidation, home repair, or other personal costs. LendingClub is a great choice for consumers looking for a personal loan solution because of its strong dedication to client care and track record of success.

9.SBI Personal Loan (Best Place To Get A Personal Loan)

For a variety of reasons, the State Bank of India (SBI) stands out as one of the best places to acquire a personal loan. SBI has a great reputation for providing trustworthy banking services for decades, and it offers reasonable interest rates and flexible payback arrangements to meet a wide range of financial needs. Their application process is simple and straightforward, with possibilities for both online and in-person applications. SBI’s wide network of branches and ATMs around the country makes it simple to obtain funds and manage your loan.

Furthermore, its customer service is well-known for its responsiveness and support, guaranteeing that borrowers receive guidance and assistance throughout the term of the loan. SBI’s personal loans are a trustworthy and accessible solution for many individuals needing financial assistance, whether you’re wanting to fund a large expense, consolidate debts, or confront unexpected financial issues.

10.Moneyview

MoneyView is without a doubt one of the greatest sites to find a personal loan to meet your financial demands. MoneyView makes acquiring a personal loan quick and easy with a user-friendly mobile app and a simple online application process. They have competitive interest rates and broad eligibility conditions, so they can accommodate a wide spectrum of people. MoneyView offers loans targeted to your specific needs, whether they be for medical crises, home renovations, or debt reduction.

The approval process is quick, ensuring that you obtain the necessary funds on time. Furthermore, MoneyView’s exceptional customer service ensures that you are guided through every step of the loan application process, making MoneyView a trustworthy and convenient alternative for personal loans.

11.Faircent (Best Place To Get A Personal Loan)

Faircent is without a doubt one of the greatest locations to get a personal loan. It provides a distinct and transparent borrowing experience as a leading peer-to-peer lending platform. Faircent, unlike traditional financial institutions, links borrowers directly with individual lenders, removing intermediaries and their related fees. This not only results in competitive interest rates, but also allows borrowers to negotiate terms that best suit their financial circumstances.

Faircent assures speedy approval and transfer of funds through a straightforward and user-friendly online application process, making it a convenient solution for people in need of a personal loan. Faircent also applies robust risk assessment procedures to assure the safety and security of the lending process, providing both borrowers and lenders with a reliable and efficient platform for their financial needs.

12.Incred

Surprisingly, the greatest place to acquire a personal loan is frequently right at your fingertips. Online lending services, such as Incred, have transformed the lending environment by providing a simple and convenient option to obtain personal loans. You can simply compare numerous loan alternatives, submit applications, and obtain speedy approvals using Incred’s user-friendly interface – all from the comfort of your own home. Furthermore, Incred normally offers affordable interest rates and various repayment durations to accommodate your financial needs.

Their open and customer-focused approach offers a stress-free borrowing experience, making it the go-to option for anyone looking for a personal loan without the normal hassles associated with traditional lending organizations. Incred’s online platform should be at the top of your list if you’re looking for the finest place to receive a personal loan.

13.Kredit Bee (Best Place To Get A Personal Loan)

KreditBee is without a doubt one of the greatest locations to get a personal loan. KreditBee provides a hassle-free borrowing experience for consumers in need of immediate financial aid through its seamless and user-friendly digital platform. Their loan application process is extremely simple and effective, allowing customers to obtain funds in minutes.

KreditBee also serves a diverse variety of borrowers, including individuals with little or no credit history and low credit ratings, making it a viable alternative for many. KreditBee’s flexible repayment options and affordable interest rates add to its allure as a go-to source for personal loans. KreditBee stands out as a dependable and convenient solution for your financial needs, whether you require funds for medical emergency, education, or other unforeseen obligations.

14.Yes Bank Personal Loan

Yes Bank is without a doubt one of the greatest sites to get a personal loan. Yes Bank, which has a solid reputation for delivering convenient and flexible financial solutions, offers a variety of personal loan alternatives designed to satisfy a variety of financial demands. Personal loans are a popular alternative due to their reasonable interest rates, quick approval process, and minimal documentation requirements.

Furthermore, Yes Bank’s customer-centric approach provides a hassle-free experience, and its commitment to openness and ethical lending methods encourages consumers’ trust. Yes Bank’s personal loans are a reliable solution for anyone in need of financial assistance, whether it’s for a medical emergency, schooling, travel, or any other personal need.

15.Tata Capital Personal Loan (Best Place To Get A Personal Loan)

Tata Capital has positioned itself as a top-tier option for people looking for personal loans. Tata Capital is one of the best locations to get a personal loan because of its reputation for dependability and strong dedication to customer satisfaction. The organization provides a wide range of loan options designed to suit a variety of financial demands, such as education, healthcare, travel, or any other personal need. Borrowers may better manage their finances while enjoying the benefits of a Tata Capital personal loan thanks to their affordable interest rates and flexible repayment options.

Furthermore, their fast application procedure, rapid approval, and exceptional customer service ensure that people in need of financial aid have a stress-free experience. Because of Tata Capital’s emphasis on transparency and trust, they have earned the trust of many consumers, making them a popular choice for personal loans.

16.Shriram Finance Limited

Shriram Finance Limited is one of the top sites to get a personal loan. Shriram Finance, with a solid financial industry reputation and a commitment to customer satisfaction, provides a variety of flexible and customizable personal loan alternatives to match individual demands. Their simple and straightforward application process ensures speedy approval and transfer of funds, making it an appealing option for people in need of emergency financial aid.

Furthermore, Shriram Finance’s cheap interest rates and open terms and conditions make it a reliable option for consumers seeking a personal loan with confidence. Shriram Finance Limited continually proven to be a dependable and customer-centric lending institution, whether for an emergency expense, debt consolidation, or any other financial requirement.

17.HDFC Bank Personal Loan (Best Place To Get A Personal Loan)

HDFC Bank is largely regarded as one of the best venues in India to receive a personal loan. With a reputation for dependability and customer-centric services, HDFC provides a diverse selection of personal loan choices to meet a variety of financial demands. Whether you want to consolidate your debts, fund a wedding, or cover unexpected needs, HDFC offers reasonable interest rates, flexible payback terms, and an easy application process.

Their effective loan approval method provides a short turnaround time, making it an excellent solution for people who require emergency financial aid. Furthermore, HDFC’s customer service is well-known for its responsiveness and assistance, resulting in a smooth borrowing experience. When it comes to personal loans, HDFC is a popular alternative for many people looking for dependable financial solutions.

18.Fibe Personal Loan

Many borrowers consider Fibe to be the greatest place to get a personal loan when looking for the best place to get a personal loan. Fibe’s name is linked with trust and dependability in the financial business. Fibe ensures that consumers may obtain a loan that meets their financial needs by offering reasonable interest rates and flexible payback terms. The application process is simple and straightforward, making it simple to apply for a personal loan online. Fibe also takes pride on its quick approval process, which ensures that borrowers get access to the funds they require in a timely manner.

Furthermore, their commitment to openness and great customer service distinguishes them, giving borrowers the piece of mind they require when choosing a personal loan. Fibe’s reputation as a reputable lender makes it a popular choice for people looking for a personal loan, whether for a significant purchase, debt consolidation, or unforeseen needs.

19.ICICI Bank Personal Loan (Best Place To Get A Personal Loan)

For a variety of reasons, ICICI Bank stands out as one of the best places to acquire a personal loan. With its enormous branch network and strong internet presence, the bank provides unrivaled accessibility to consumers across India. Its low interest rates and flexible repayment options meet a wide range of financial requirements.

Furthermore, ICICI Bank’s quick loan approval and minimum documentation requirements make the application procedure simple. Borrowers trust the bank because of its reputation for transparency and customer-centric services. Whether it’s for a dream vacation, a medical emergency, or a home renovation, ICICI Bank provides the financial assistance that consumers require, making it a top choice for those looking for a personal loan.

20.Bajaj Finserv

For a variety of reasons, Bajaj Finserv is the best place to receive a personal loan. Bajaj Finserv, with its exceptional track record and reputation in the financial industry, provides a frictionless and customer-centric borrowing experience. Their application process is simple and quick, with few paperwork needs.

Furthermore, they provide incredibly competitive interest rates and numerous repayment alternatives, allowing consumers to customize their loan to match their individual financial circumstances. Because of its broad branch network and online presence, Bajaj Finserv is available to a wide spectrum of customers. Furthermore, borrowers benefit from their commitment to openness and ethical lending methods. If you’re seeking for a dependable source of personal lending, Bajaj Finserv is certainly the best option.

21.IndusInd Bank Personal Loan (Best Place To Get A Personal Loan)

Individuals seeking financial assistance might consider IndusInd Bank as one of the best venues to acquire a personal loan. IndusInd Bank provides a smooth and hassle-free application procedure because to its customer-centric approach and reputation for speedy service. Whether for unexpected medical bills, debt consolidation, or realizing a dream vacation, the bank offers various lending solutions suited to borrowers’ unique circumstances. Competitive interest rates and a variety of repayment terms make IndusInd Bank a popular choice for personal loans.

Furthermore, their customer service is well-known for its timeliness and guidance throughout the loan application and approval procedure, ensuring that customers receive the necessary financial aid on time. IndusInd Bank has gained a reputation as a trustworthy provider of personal loans by emphasizing transparency and honesty.

22.Kotak Personal Loan

Kotak Mahindra Bank is largely recognized as one of the top venues in India to get a personal loan. Kotak, with its reputation for dependability and customer-centric services, provides a smooth and trouble-free experience for people in need of financial aid. Whether you want to pay for a dream vacation, consolidate debts, or cover unforeseen needs, Kotak’s personal loans offer flexible repayment options, reasonable interest rates, and rapid approval processes.

The bank’s commitment to transparency, combined with its simple online application process, makes it a popular option for people looking for personal loans. Kotak’s commitment to customer satisfaction, as well as its wide branch network, strengthen its position as a top location for obtaining a personal loan, guaranteeing that your financial needs are fulfilled efficiently and effectively.

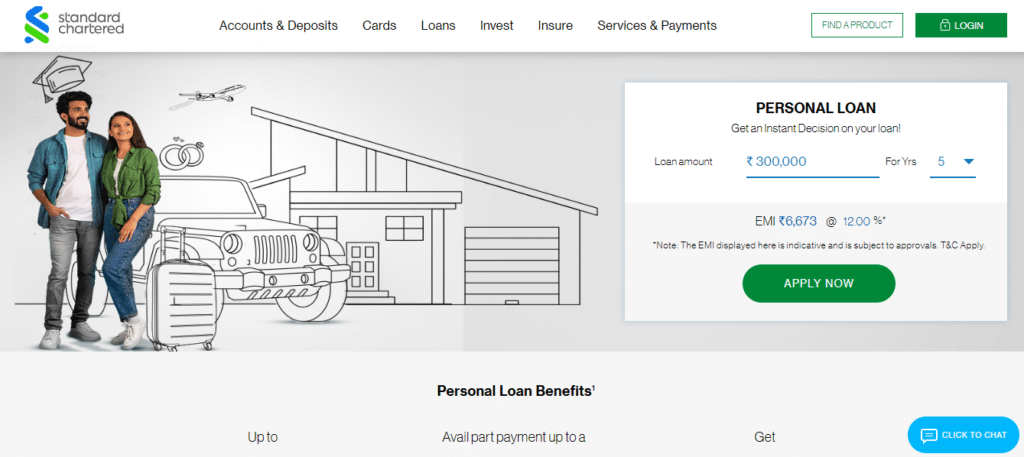

23.Standard Chartered Personal Loan (Best Place To Get A Personal Loan)

Standard Chartered Bank is well-known for being one of the best places to get a personal loan. Standard Chartered, with its long history of financial competence and global exposure, provides a variety of lending alternatives tailored to individual needs. Standard Chartered’s personal loans provide reasonable interest rates, flexible repayment terms, and speedy approval processes, whether you’re wanting to support a significant life event, consolidate existing debts, or simply need some extra cash for personal expenses.

Their dedication to client satisfaction, transparency, and appropriate lending procedures distinguishes them in the market, making them a top choice for people in need of financial aid. When you pick Standard Chartered for a personal loan, you can be confident in their commitment to assisting you in meeting your financial objectives while providing a hassle-free borrowing experience.

24.Cent Personal Loan

The central bank is often considered one of the best places to obtain a personal loan due to its reputation for stability, reliability, and competitive interest rates. Central banks are government-regulated financial institutions responsible for overseeing a nation’s monetary policy and ensuring the overall financial health of the country.

When you secure a personal loan from a central bank, you benefit from their rigorous standards and stringent lending practices, which can provide a sense of security and trust for borrowers. Additionally, central banks typically offer favorable interest rates and repayment terms, making it an attractive option for those in need of financial assistance. Whether it’s for funding a major purchase or consolidating debt, obtaining a personal loan from a central bank can be a prudent financial choice for many individuals.

25.Axis Bank Personal Loan (Best Place To Get A Personal Loan)

Axis Bank is widely regarded as one of the best places to secure a personal loan, and for good reason. With its extensive network of branches and a strong online presence, it offers convenience and accessibility to potential borrowers. The bank provides competitive interest rates and flexible repayment terms, ensuring that borrowers can find a loan that suits their financial needs.

Axis Bank’s loan application process is streamlined and efficient, reducing the hassle of paperwork and long waiting times. Moreover, the bank’s transparent and customer-centric approach ensures that borrowers are well-informed throughout the lending process. Whether you need funds for a medical emergency, a dream vacation, or debt consolidation, Axis Bank’s personal loans offer a reliable solution that can help you achieve your financial goals with ease.

26.Citibank Personal Loan

Citibank is largely regarded as one of the best locations to acquire a personal loan, and for good reason. Citibank, with its longstanding reputation for financial stability and global reach, offers reasonable interest rates and a simplified application process, making it an appealing choice for individuals seeking personal financing. The bank’s commitment to client service is obvious in its flexible lending terms and flexibility to personalize loan alternatives to meet individual needs.

Citibank’s online tools and resources make it simple to compare loan offers, and their professional staff is accessible to assist and guide you during the application process. Citibank’s personal loans provide a dependable and trustworthy solution for your financial needs, whether you’re trying to consolidate debt, cover unforeseen bills, or finance a large purchase.

27.Bank of Baroda Personal Loan (Best Place To Get A Personal Loan)

Bank of Baroda is one of India’s finest financial organizations, and it is unquestionably one of the best places to acquire a personal loan. With a long history of trust and dependability, the bank offers affordable interest rates and flexible repayment alternatives, making it an appealing option for people in need of financial aid.

Their customer-centric strategy assures a simple application process, and with a large network of locations and digital platforms, they make it easy to obtain their services. Bank of Baroda’s commitment to openness and timely loan disbursement makes it a popular choice for consumers looking for personal loans, making it a top choice for meeting a variety of financial demands.

28.IDFC First Bank Personal Loan

IDFC First Bank is well-known for being one of the best places to get a personal loan. When it comes to personal loans, the bank stands out for its efficiency and ease thanks to its customer-centric approach and a variety of specialized financial options. IDFC First Bank provides reasonable interest rates, flexible repayment choices, and speedy approval.

IDFC First Bank is here to help you if you need money for a medical emergency, a house renovation, or any other personal financial necessity. Their clear and simple loan application process, together with the support of competent financial advisors, guarantees that customers enjoy a stress-free experience when applying for a personal loan. It’s no surprise that IDFC First Bank is a popular option for people in need of financial assistance.

29.Canara Bank Personal Loan (Best Place To Get A Personal Loan)

Canara Bank is often considered one of the best places to obtain a personal loan in India. Known for its reputable and customer-friendly banking services, Canara Bank offers a range of personal loan products that cater to various financial needs. With competitive interest rates, flexible repayment options, and a straightforward application process, Canara Bank ensures that individuals have access to the funds they require for personal expenses, whether it’s for education, medical emergencies, home renovations, or other financial goals.

The bank’s efficient customer service and quick loan approval make it a top choice for those seeking a reliable and hassle-free personal loan experience. Additionally, Canara Bank’s widespread network of branches and ATMs across the country makes it accessible to a broad spectrum of borrowers, enhancing its reputation as a trusted institution for personal loans.

30.SMFG India Credit

SMFG India Credit is without a doubt one of the greatest sites in India to acquire a personal loan. SMFG India Credit stands out for its customer-centric approach and competitive interest rates, with a good track record of providing financial solutions to individuals. SMFG India Credit offers various loan solutions tailored to your needs, whether you need finances for a medical emergency, home improvement, school, or any other reason.

The application process is simple and efficient, ensuring timely approvals and disbursal of funds. Furthermore, their clear terms and inexpensive processing costs make them a dependable option for people in need of financial aid. When you need a personal loan, rely on SMFG India Credit since they are dedicated to assisting you in meeting your financial objectives with ease and comfort.

How Do Personal Loans Work?

A lender will transfer the funds, less any origination charge, in a lump sum into your bank account within a few days of you being authorized for a personal loan. You can use the money for almost anything once you have it.

Repayment usually begins 30 days after receiving the funds. You can pay the fixed monthly amount directly or set up auto-pay from your bank account with various lenders. The monthly payments will continue until the loan term expires, or unless you make additional loan payments. When you have paid off your personal loan completely, it is over.

Conclusion Best Place To Get A Personal Loan

Finally, when it comes to locating the best site to receive a personal loan, the State Bank of India (SBI) is a top option. SBI’s reputation for dependability, affordable interest rates, and flexible loan durations makes it an appealing alternative for people with a wide range of financial demands. its application process’s ease, wide branch network, and exceptional customer service all contribute to its standing as a preferred lending company.

SBI is a valued partner in their financial journey because of its dedication to assisting borrowers in navigating their financial issues and achieving their goals. So, if you’re looking for a personal loan, SBI’s options are worth examining, and they constantly rank among the best in the market.

FAQ Best Place To Get A Personal Loan

What is a personal loan?

A personal loan is an unsecured loan that can be used for a variety of purposes, including debt consolidation, home improvements, medical bills, and unanticipated expenses. Personal loans, unlike secured loans such as a mortgage or auto loan, do not require collateral.

Where is the best place to get a personal loan?

The best site to receive a personal loan is determined by your unique requirements and financial circumstances. Personal loans are commonly obtained via traditional banks, credit unions, online lenders, and peer-to-peer lending platforms. Each has advantages and disadvantages.

Are traditional banks a good place to get personal loans?

Personal loans are available from traditional banks, which might be an excellent alternative if you have a strong banking relationship and a good credit score. They may, however, have more severe application procedures and longer approval times.

What about credit unions?

Credit unions are member-owned financial institutions that frequently offer competitive personal lending rates and durations. If you belong to a credit union, you should look into their services.

Are online lenders a viable option for personal loans?

Online lenders, such as peer-to-peer lending platforms, make it easy to apply for personal loans. They may offer lower rates and speedier approval processes, but make sure to do your homework and choose a reliable online lender.

What documents and information do I need to apply for a personal loan?

Lenders typically require proof of identity, income, and employment, as well as information about your expenses and debts. You may need to provide recent pay stubs, tax returns, bank statements, and personal identification.