Best Loan App For Low Credit Score are Finding a trustworthy loan can be difficult for people with low credit scores, but there are a number of applications that are designed with this group of people in mind and provide easily accessible financial options. An exceptional example of such an app is “Earnin.” Earnin helps with short-term financial demands by enabling users to access their earned money prior to payday, even though it’s not a standard loan app. “Branch,” which offers loans designed for people with weaker credit ratings, is another noteworthy choice. In order to provide Customized loan alternatives, Branch assesses the user’s financial behaviour, including income and spending patterns.

“MoneyLion” is an additional application that offers a range of financial instruments, such as credit builder loans, to individuals with imperfect credit. Because these apps have a higher risk because of the lower credit score, it is important to thoroughly analyse the terms, interest rates, and fees related to them. For those with poor credit, looking into neighbourhood banks and credit unions may also lead to more individualised and reasonably priced lending possibilities.

How We Choose Best Loan App For Low Credit Score?

It’s important to carefully weigh a number of aspects when selecting the best loan app for a low credit score to make sure it meets your needs financially and has reasonable conditions. These are important standards to assess:

Interest Rates and Fees: Examine the fees and interest rates related to loans provided by various apps. High annual percentage rates (APRs) and other fees should be avoided as they can have a big effect on the total cost of borrowing.

- Advertisement -

Review the loan terms: taking note of the length of time that must be repaid. Select an app that, in light of your financial circumstances, offers flexible and affordable payback choices.

Evaluate the app’s usability: as well as the speed at which loans are approved and disbursed. Apps that provide quick and simple processes are preferred by many consumers, particularly in times of financial need.

Credit Reporting: Verify whether the app notifies credit bureaux of your loan activity. For those who want to increase their creditworthiness, this feature can be extremely important as timely loan payments have a good effect on your credit score.

Customer Testimonials: Examine user reviews and comments to get a sense of other users’ experiences with the software. This can reveal details like the dependability, quality of customer support, and general satisfaction of the app.

Here Is List of The Best Loan App For Low Credit Score

- mPokket

- LazyPay

- Money View

- Bajaj Finserv

- Home Credit

- SmartCoin

- CASHe

- NIRA

- KreditBee

- PaySense

- MoneyTap

- PayMeIndia

- Dhani

- Early Salary

- India Lends

- Paytm Pay Later

- Zest Money

- DigiMoney

- IndusMobile: Digital Banking

- Mystro Loans & Neo Banking App

- Kissht

- Prefr

- Fair Money

- Pay With Ring

- Bueno Loans

- Pocketly

- Bajaj Markets

- Indialends

- ExtraLend

- MoneyMutual

30 Best Loan App For Low Credit Score

1.mPokket

mPokket is a well-known lending app that provides a dependable and easily accessible financial option for people with bad credit. In contrast to conventional lenders that frequently give priority to credit history, mPokket takes a different tack by taking into account other variables including social and academic profiles.

With this all-inclusive approach, consumers with little or no credit history can quickly obtain much-needed finances. People with lesser credit ratings find the app appealing because of its easy-to-use layout and quick application process. With its speedy approval processes and adaptable repayment plans, mPokket offers a financial lifeline to people who are struggling, promoting financial inclusion and empowerment for a larger population.

2.LazyPay

LazyPay stands out as a model loan application designed to meet the financial requirements of those with bad credit. Understanding that these consumers have difficulty obtaining traditional loans, LazyPay uses cutting-edge algorithms and non-traditional data sources to evaluate creditworthiness in a way that goes beyond typical credit score measurements. This kind of thinking opens possibilities for people who might have been passed over by traditional financial institutions and makes lending more inclusive.

LazyPay appeals especially to people who need rapid and easy access to funds because of its user-friendly design and short approval process. LazyPay is a dependable and easily accessible financial solution that helps close the gap for people with less-than-perfect credit records thanks to its clear terms and flexible payback options.

3.Money View

Money View is an excellent lending software designed especially for people who struggle with bad credit. Money View is a progressive credit evaluation approach that takes into account a variety of financial parameters outside of typical credit scores in recognition of the difficulties this group faces. This novel strategy guarantees a more welcoming lending climate, enabling customers who might have been disenfranchised from traditional financial institutions.

For those in need, the application procedure is streamlined and the app’s user-friendly layout makes borrowing easier. With its affordable interest rates, flexible repayment options, and dedication to transparency, Money View stands out as a reliable and approachable financial partner for individuals looking to improve their credit situation even in the face of a less-than-ideal credit history.

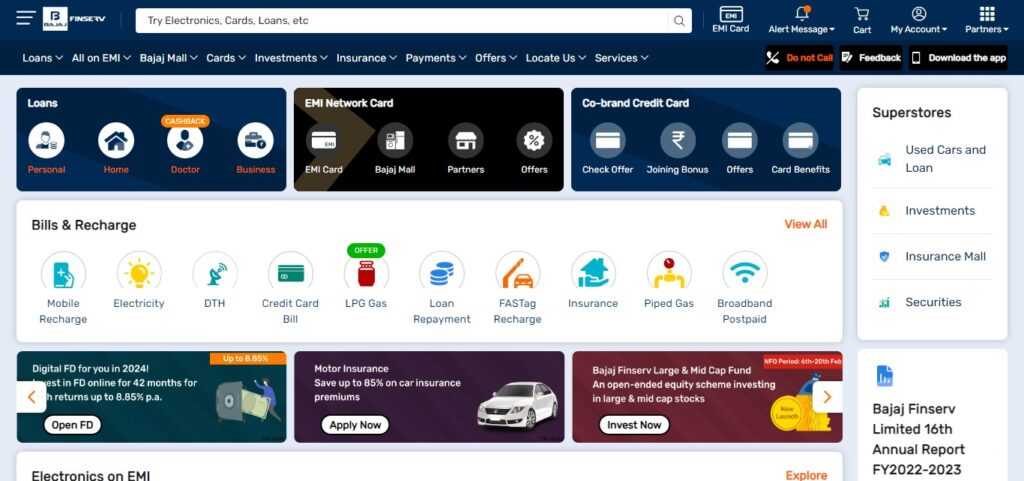

4.Bajaj Finserv

An outstanding loan app is Bajaj Finserv, particularly for those with poor credit scores. Understanding the difficulties these borrowers encounter, Bajaj Finserv uses a comprehensive method to assess creditworthiness, accounting for a number of financial factors other than typical credit scores. Opportunities are created by this inclusive approach for those who might have had trouble obtaining loans through traditional routes. A broader audience can utilise the app because of its user-friendly UI, which guarantees a smooth and hassle-free application process.

Fast approval times and flexible repayment options demonstrate Bajaj Finserv’s dedication to offering financial solutions and create a welcoming atmosphere for borrowers aiming to better their financial situation. Even if you don’t have the best credit history, Bajaj Finserv is still a trustworthy partner for people in need of financial support because of its reasonable interest rates and assortment of loan options.

5.Home Credit

Home Credit is a great loan tool, especially for those who are struggling with low credit ratings. Comprehending the difficulties encountered by this group, Home Credit employs a distinctive methodology that evaluates creditworthiness by taking into account supplementary information and repayment patterns. This novel approach makes lending more inclusive by providing financial assistance to people who are typically disregarded by traditional banks.

Users looking for a simple and quick financial solution are catered to by the app’s user-friendly interface and easy application process. Home Credit offers borrowers the chance to repair their credit history through flexible terms and customised repayment plans, demonstrating its dedication to flexibility. Focusing on financial inclusion, Home Credit is a trustworthy and encouraging partner for people who are having trouble obtaining loans because of low credit scores.

6.SmartCoin

As an excellent lending software created especially to meet the demands of those with low credit scores, SmartCoin stands out. Understanding the difficulties this group has getting access to traditional loans, SmartCoin uses sophisticated algorithms that go beyond standard credit evaluations. The software creates a more inclusive financing environment by evaluating creditworthiness using novel approaches and different data points.

Because of its easy-to-use design, SmartCoin is available to anyone looking for quick and convenient financial aid. For those with less-than-ideal credit records, SmartCoin offers a lifeline with quick approval times and clear terms. For people trying to get over credit obstacles and get loans on schedule, the app is a dependable option because of its dedication to financial inclusion and innovation.

7.CASHe

CASHe is a great lending software that is especially helpful for people who are struggling with low credit ratings. Recognising the financial difficulties this group has, CASHe uses a cutting-edge credit-scoring algorithm that extends beyond conventional credit histories. CASHe fosters a more inclusive financing environment by taking into account variables including employment details, social behaviour, and repayment capacity. This opens up options for those who have historically been turned away by traditional financial institutions.

The app is a practical choice for consumers in need of immediate financial solutions because of its user-friendly interface and speedy processing. CASIn addition to offering affordable interest rates and flexible repayment alternatives, his dedication to openness presents it as a trustworthy and approachable financial partner for people looking to go beyond credit obstacles and get access to funds on time.

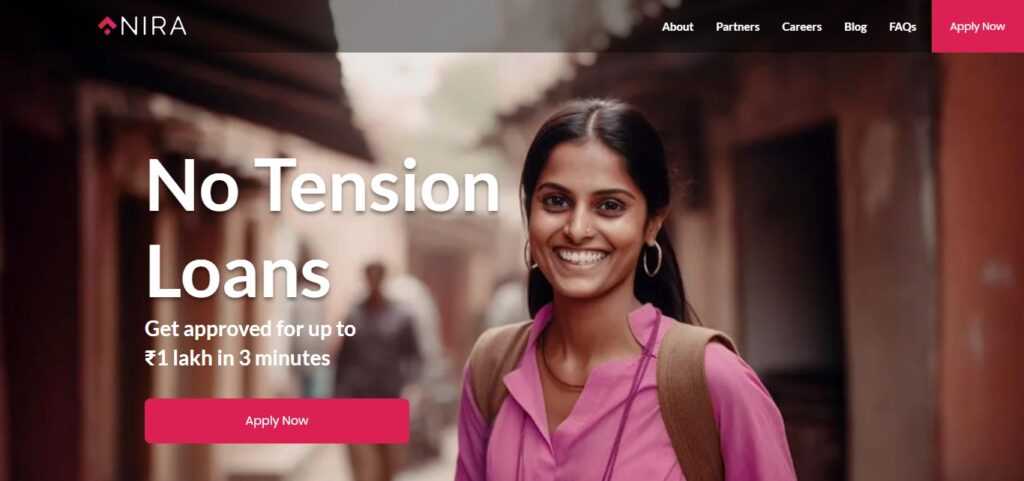

8.NIRA

When it comes to lending apps, NIRA is the best choice, especially for those with poor credit. Understanding the difficulties this group faces, NIRA uses a progressive credit evaluation approach that considers a range of financial factors outside of typical credit scores. This innovative strategy gives people options who might not have been able to obtain loans through traditional means. Accessible to a wider range of users, NIRA’s user-friendly design guarantees a smooth and hassle-free application procedure.

The app offers a friendly environment for borrowers who want to improve their financial status despite having a less-than-ideal credit history, and it is clear that it is committed to delivering financial solutions based on its speedy approval timeframes and flexible repayment alternatives. NIRA presents itself as a dependable and inclusive choice for anyone in need of financial aid, offering a variety of loan packages and low interest rates.

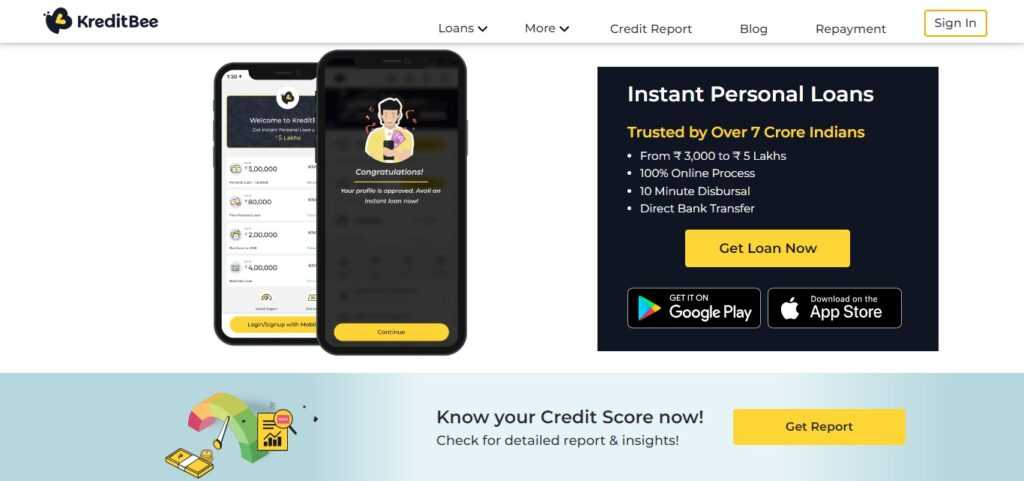

9.KreditBee

Among the best loan apps available is KreditBee, which is especially helpful for people with bad credit. Recognising the difficulties this group has, KreditBee uses a progressive credit evaluation model that considers a number of factors in addition to traditional credit ratings to determine creditworthiness. For those that conventional loan institutions might have passed over, this creative strategy opens doors. The app is available to people looking for simple and quick financial solutions because of its user-friendly interface and shortened application process.

The clear terms and conditions of KreditBee demonstrate the company’s dedication to openness and guarantee that borrowers are aware of every step of the financing procedure. KreditBee is a dependable and inclusive financial platform that offers flexible repayment alternatives and quick approval times. This makes it an invaluable resource for people who want to get loans but are having trouble with their credit scores.

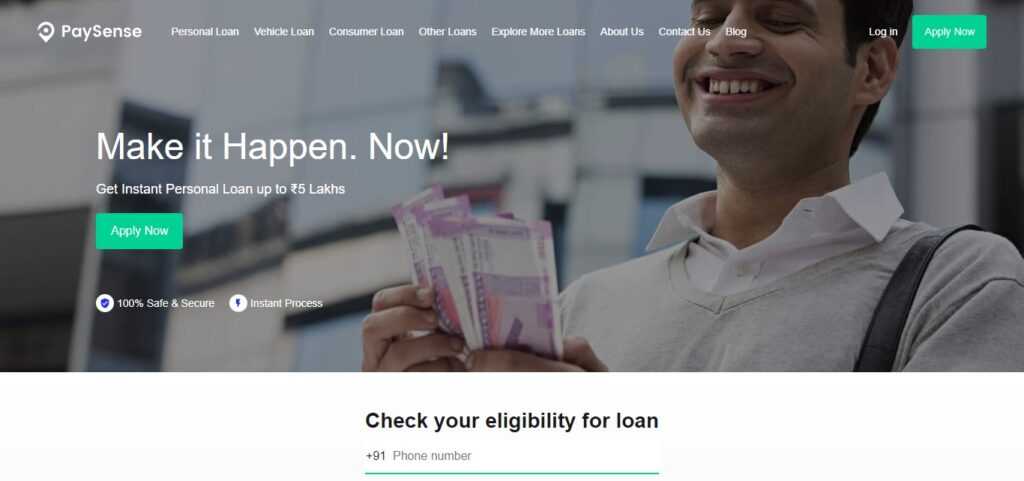

10.PaySense

PaySense is a great lending software that is especially useful for people who are struggling with low credit scores. Understanding the challenges this group faces, PaySense uses a progressive credit evaluation model that takes into account a number of financial factors outside of typical credit scores. This inclusive strategy provides opportunities for those who might have trouble obtaining loans through conventional channels. The app is accessible to people in need of quick and easy financial solutions due to its user-friendly interface and simple application process.

PaySense offers a helpful atmosphere for borrowers who are trying to overcome credit obstacles, and their quick approval processes and flexible repayment alternatives demonstrate their commitment to financial inclusion. In spite of a less-than-ideal credit history, PaySense is a dependable and approachable financial partner with affordable interest rates and a commitment to transparency, enabling people to take care of their financial needs.

11.MoneyTap

MoneyTap stands out as a superb loan app that was created especially to serve those with bad credit. Recognising the difficulties this group faces, MoneyTap uses a novel approach to credit evaluation that goes beyond conventional scoring techniques. Through the consideration of several financial characteristics and the utilisation of alternative data sources, the app offers a platform that is inclusive to individuals who have historically been marginalised by major financial institutions. Because of MoneyTap’s user-friendly interface, applying for a loan is easier and more accessible to a wider audience.

The app’s quick approval procedure and adjustable repayment alternatives demonstrate its dedication to financial inclusion and provide a lifeline to people who need financial support now but haven’t had the best credit history. MoneyTap is a dependable and empowering option for borrowers trying to manage their financial difficulties with a poor credit score because of its clear conditions and affordable interest rates.

12.PayMeIndia

PayMeIndia sets itself out as a very successful lending app, especially for people who struggle with bad credit. PayMeIndia uses a progressive credit assessment technique, which looks beyond traditional credit ratings and takes into consideration numerous indicators to measure creditworthiness, in recognition of the financial challenges this demographic faces. This creative strategy opens doors for people who might have had trouble getting loans through traditional channels. Those looking for quick and easy financial solutions can find the app more accessible because to its user-friendly UI and simplified application process.

PayMeIndia’s dedication to promoting financial inclusion is evident in its quick approval processes and adaptable repayment plans, which offer a helping hand to borrowers trying to get beyond credit obstacles. PayMeIndia is a reliable and approachable financial partner that provides vital support to borrowers with poor credit histories by offering cheap interest rates and an emphasis on transparency.

13.Dhani

Dhani has made a name for itself as a unique lending software, especially helpful for people with bad credit. Recognising the difficulties this group faces, Dhani uses a sophisticated credit evaluation algorithm that goes beyond standard credit ratings to determine creditworthiness by taking into account a number of financial factors. For those who might have had trouble getting loans through traditional means, this creative strategy opens doors. Because of its easy-to-use design and smooth application process, Dhani is a suitable choice for anyone looking for quick and easy financial solutions.

The app offers a helpful atmosphere for borrowers looking to improve their financial status despite having a less-than-ideal credit history, and it is clear that it is committed to giving financial support based on its quick approval times and flexible repayment alternatives. For borrowers who are trying to obtain loans but are having trouble with their credit scores, Dhani is a dependable and inclusive choice because of its competitive interest rates and variety of loan options.

14.Early Salary

As an excellent loan app, EarlySalary is tailored to meet the financial requirements of people with bad credit. Understanding the challenges this group faces, EarlySalary uses a novel method of credit evaluation that takes into account a number of financial factors outside of typical credit scores. For those who might have trouble getting loans through traditional channels, this inclusive approach creates opportunities. The application procedure is quick and easy, making the app more accessible and giving individuals in need of financial assistance a quick and easy way to get it.

EarlySalary’s dedication to financial inclusion is evident in its quick approval processes and adaptable repayment plans, which foster a helpful atmosphere for borrowers trying to get beyond credit obstacles. Even for those with less-than-ideal credit histories, EarlySalary remains a trustworthy and empowering choice due to its competitive interest rates and emphasis on transparency.

15.India Lends

IndiaLends is a great lending software that is especially helpful for people who are struggling with low credit scores. IndiaLends uses a progressive credit assessment approach that considers a variety of financial indicators in addition to traditional credit ratings to determine creditworthiness, in recognition of the difficulties this demographic faces. This innovative strategy offers chances to people who might have trouble getting loans through traditional channels. The application’s well navigable interface and uncomplicated application process augment accessibility, rendering it a practical choice for individuals in search of prompt and effective financial resolutions.

With its fast approval timeframes and flexible repayment alternatives, IndiaLends demonstrates its dedication to financial inclusion while providing a friendly atmosphere for borrowers with less-than-ideal credit histories who are navigating their financial issues. IndiaLends is a trustworthy and inclusive financial partner that offers affordable interest rates and transparent terms. It helps those who are seeking loans but are having difficulties because of their credit scores.

16.Paytm Pay Later

Paytm Pay Later is an excellent loan software that is especially helpful for people with bad credit. Paytm Pay Later has implemented an inclusive approach in its evaluation process, taking into account financial characteristics beyond standard credit ratings, in recognition of the financial constraints encountered by this demographic. People who might have trouble getting loans through traditional channels now have opportunities thanks to this innovative technique. The application’s easy-to-use interface and uncomplicated application procedure improve accessibility and offer individuals in need of financial assistance a prompt and effective option.

Fast approval timeframes and flexible repayment options demonstrate Paytm Pay Later’s dedication to financial inclusion and foster a helpful atmosphere for borrowers attempting to overcome credit difficulties. In spite of a less-than-ideal credit history, Paytm Pay Later remains a dependable and empowering choice for people in need of financial support due to its clear terms and easy integration into the popular Paytm platform.

17.Zest Money

ZestMoney is a remarkable lending software that provides a helpful option for those with bad credit. ZestMoney uses an advanced credit assessment algorithm that goes beyond typical credit ratings since it recognises the difficulties this group faces. Through the consideration of several financial factors and the utilisation of alternative data sources, the application offers a platform that is inclusive to individuals who would encounter challenges in obtaining loans through traditional channels. ZestMoney is available to a wider audience due to its user-friendly interface, which guarantees a smooth and hassle-free application process.

The app provides a helpful environment for borrowers who are trying to overcome credit obstacles, and it is clear that it is committed to financial inclusion based on its speedy approval timeframes and flexible repayment alternatives. Despite the difficulties associated with having a low credit score, ZestMoney is a dependable and empowering choice for people in need of financial support because of its competitive interest rates and commitment to openness.

18.DigiMoney

DigiMoney is a trustworthy loan software that is a great financial partner, especially for people who are struggling with low credit ratings. Understanding the constraints this group faces, DigiMoney uses a progressive credit evaluation model that extends beyond traditional credit scores. Through the use of cutting-edge evaluation techniques and a variety of financial metrics, the app opens doors for people who might otherwise struggle to obtain loans through conventional channels. DigiMoney’s intuitive user interface and expedited application procedure improve accessibility by providing individuals in need with a prompt and effective financial solution.

Fast approval timeframes and flexible repayment options demonstrate the app’s dedication to financial inclusion, creating a welcoming atmosphere for borrowers who want to better their financial situation even in the face of a less-than-ideal credit history. DigiMoney is a good choice for people who need financial support but are trying to manage the limitations of having a low credit score because of its clear conditions and emphasis on user empowerment.

19.IndusMobile: Digital Banking

IndusMobile: Digital banking is a great resource, particularly for those looking for dependable financial services but with bad credit. Understanding the difficulties this group faces, IndusMobile uses a cutting edge digital banking strategy that goes beyond conventional credit scoring. By taking into account a variety of financial factors and applying cutting-edge technology to credit evaluation, the app creates an inclusive atmosphere. For individuals in need, IndusMobile’s user-friendly design and extensive digital banking capabilities guarantee effortless accessibility and make the loan application procedure less complicated.

With quick approval timeframes and flexible repayment alternatives, the platform demonstrates its dedication to financial inclusion and fosters a welcoming atmosphere for borrowers who want to meet their financial demands even in the face of less-than-ideal credit histories. For those looking for financial support while navigating the difficulties brought on by a low credit score, IndusMobile is not just a practical digital banking option but also a trustworthy and empowering source.

20.Mystro Loans & Neo Banking App

The Mystro Loans & Neo Banking App is an excellent option that is especially helpful for people who are struggling with low credit scores. Understanding the challenges this group faces, Mystro uses a progressive credit evaluation mechanism that goes above and beyond traditional scoring techniques. Through the use of neo-banking principles and a variety of financial metrics, the app provides opportunities for people who might otherwise have difficulty obtaining loans through conventional channels. The Mystro app’s smooth integration of loan services and neo-banking capabilities provides a comprehensive financial ecosystem in addition to streamlining the application procedure.

For individuals in need, the user-friendly design guarantees accessibility and offers a quick and effective financial solution. Quick approval times and flexible repayment alternatives demonstrate Mystro’s dedication to financial inclusion and foster a friendly environment for borrowers who want to better their financial status but are having difficulties with their credit ratings. The Mystro Loans & Neo Banking App, which combines loan services with neo-banking features, is a dependable and powerful option for people who need financial support but are unable to manage the limitations of a low credit score.

21.Kissht

Kissht is an excellent loan app that is especially designed to meet the needs of people who are struggling with bad credit. Kissht uses an innovative credit evaluation approach that considers a variety of financial criteria in addition to typical credit ratings to assess creditworthiness, taking into account the difficulties this demographic faces. This creative strategy opens doors for people who would have trouble getting loans through traditional channels.

Kissht’s intuitive user interface and expedited application procedure improve accessibility by offering individuals in need a prompt and effective financial answer. The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and create a helpful atmosphere for borrowers trying to clear credit obstacles. Even for those with less-than-ideal credit histories, Kissht remains a dependable and powerful choice because to its competitive interest rates and emphasis on transparency.

22.Prefr

Prefr is an app that is worth using for loans, especially for those with poor credit scores. Understanding the financial difficulties this group has, Prefr uses a novel approach to credit evaluation that goes beyond typical credit scores. Through the consideration of several financial characteristics and the integration of other data sources, the application generates options for individuals who might face challenges in obtaining loans through traditional channels. Prefr’s easy-to-use interface and expedited application procedure improve accessibility and provide those in need with a prompt and effective financial solution.

The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and create a helpful environment for borrowers who have less-than-ideal credit histories but are still trying to manage their financial difficulties. Prefr is a dependable and approachable choice for people looking for financial support while managing the limitations of a low credit score because of its competitive terms and emphasis on customer empowerment.

23.Fair Money

As a top lending app, Fair Money distinguishes out because it was created especially to help people who are struggling with low credit scores. Understanding the constraints this group faces, Fair Money uses a cutting-edge approach for credit evaluation that goes beyond conventional scoring techniques. Through the consideration of several financial characteristics and the utilisation of alternative data, the app provides opportunities for individuals who would face challenges in obtaining loans through traditional channels. Fair Money’s easy-to-use interface and smooth application procedure increase accessibility and give individuals in need a quick and effective financial solution.

The app fosters a friendly environment for borrowers who want to better their financial status despite having a less-than-optimal credit history, and it is clear that it is committed to financial inclusion given its quick approval times and flexible repayment alternatives. Fair Money is a dependable and empowering choice for anyone looking for financial support while managing the limitations of a low credit score because of its clear conditions and attractive features.

24.Pay With Ring

The RING Instant Cash Loan app distinguishes itself by offering a quick and easy personal loan solution, with a focus on quick approval to satisfy customers’ urgent financial demands. This software presents itself as a dependable resource for acquiring prompt and easy financial assistance, guaranteeing that people can get the money they need without needless delays.

The focus on quick approval is a reflection of RING’s dedication to providing a quick and easy borrowing experience. Because it enables users to obtain the required funds quickly, this feature can be very helpful for people who are in dire financial difficulties. This makes the RING Instant Cash Loan app a viable choice for people looking for personal loans that are accessible and rapid.

25.Bueno Loans

An excellent loan app called Bueno Loans was created especially to meet the financial demands of people who struggle with low credit scores. Acknowledging the difficulties this group has, Bueno Loans uses a novel credit evaluation technique that considers a number of financial factors in addition to typical credit ratings to determine trustworthiness. This innovative strategy offers chances to people who might have trouble obtaining loans through traditional channels.

Bueno Loans’ user-friendly design and simplified application procedure improve accessibility by giving those in need of financial assistance a timely and effective answer. The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and create a helpful environment for borrowers who may have a less-than-ideal credit history but are still trying to manage their financial difficulties. Bueno Loans is a dependable and approachable choice for anyone looking for financial support while managing the limitations of a poor credit score because of its competitive terms and emphasis on customer empowerment.

26.Pocketly

Standout among lending apps is Pocketly, which is especially helpful for people with bad credit. Recognising the financial difficulties this group has, Pocketly uses a progressive credit evaluation strategy that extends beyond credit ratings. Through the use of creative thinking and a range of financial criteria, the app provides opportunity for people who might otherwise have difficulty obtaining loans through traditional channels. For those in need, Pocketly’s easy-to-use interface and expedited application procedure improve accessibility by offering a prompt and effective financial solution.

The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and foster a welcoming environment for borrowers who want to raise their credit scores but are having difficulties doing so. Pocketly is a dependable and approachable choice for people looking for financial support while managing the limitations of a low credit score because of its competitive features and emphasis on user empowerment.

27.Bajaj Markets

A dependable and user-friendly lending software, Bajaj Markets is particularly helpful for people who are struggling with low credit scores. Understanding the financial difficulties this group faces, Bajaj Markets uses a cutting-edge credit evaluation technique that goes beyond typical credit scores. Through the application of advanced methods and consideration of multiple financial characteristics, the app opens doors for people who might otherwise struggle to obtain loans through traditional channels.

The streamlined application procedure and user-friendly interface of Bajaj Markets improve accessibility by providing individuals in need with a prompt and effective financial solution. The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and create a helpful atmosphere for borrowers trying to clear credit obstacles. For those looking for financial support while managing the limitations of a low credit score, Bajaj Markets is a dependable and inclusive choice because of its competitive features and commitment to user empowerment.

28.Indialends

IndiaLends is an excellent lending software that is especially helpful for people who are overcoming the difficulties associated with having a low credit score. Recognising the financial challenges this group faces, IndiaLends uses an advanced credit evaluation mechanism that goes beyond conventional scoring techniques. Through the use of creative evaluation techniques and a range of financial characteristics, the app opens doors for people who might otherwise struggle to obtain loans through traditional channels. The easy-to-use interface and smooth application procedure of IndiaLends increase accessibility and offer individuals in need a prompt and effective financial solution.

Fast approval timeframes and flexible repayment alternatives demonstrate the app’s dedication to financial inclusion and create a welcoming environment for borrowers who want to better their financial situation even in the face of a less-than-ideal credit history. IndiaLends presents itself as a dependable and powerful choice for people looking for financial support while navigating the difficulties brought on by a poor credit score thanks to its clear conditions and attractive features.

29.ExtraLend

Being the best loan app, ExtraLend distinguishes out for being designed with poor credit score borrowers’ needs in mind. ExtraLend uses a cutting-edge credit assessment algorithm that goes beyond typical credit scores in recognition of the difficulties this group faces. Through the use of creative evaluation techniques and a variety of financial metrics, the app opens doors for people who might find it difficult to obtain loans through traditional channels. ExtraLend’s easy-to-use interface and expedited application procedure improve accessibility by providing those in need with a prompt and effective financial solution.

With quick approval timeframes and flexible repayment alternatives, the app demonstrates its dedication to financial inclusion and fosters a supportive atmosphere for borrowers with less-than-ideal credit histories as they handle their financial issues. Despite obstacles relating to credit scores, ExtraLend is a dependable and reachable choice for people in need of financial support because of its competitive terms and commitment to customer empowerment.

30.MoneyMutual

MoneyMutual is a notable example of a dependable and successful lending software, particularly helpful for those struggling with bad credit. Understanding the financial difficulties this group has, MoneyMutual uses a progressive credit evaluation strategy that goes beyond conventional scoring techniques. Through the use of creative thinking and a variety of financial criteria, the app opens doors for people who might otherwise struggle to obtain loans through traditional channels.

MoneyMutual’s easy-to-use interface and expedited application procedure improve accessibility by providing individuals in need with a prompt and effective financial solution. The app’s quick approval processes and adaptable repayment plans demonstrate its dedication to financial inclusion and create a helpful atmosphere for borrowers trying to clear credit obstacles. For those looking for financial support while managing the limitations of a low credit score, MoneyMutual is a dependable and inclusive choice because of its competitive features and commitment to customer empowerment.

How To Apply For Personal Loans On Low Credit Score Loan Apps

Step 1: Download the lender’s mobile app straight from the App Store or Google Play Store.

Step 2: Create a new user account. Following the procedure, you will submit your name, address, proof of identity, and email.

Step 3: The credit limit is established here.

Step 4: After finishing, upload the KYC documentation for the personal loan contract.

Step 5: Next, to apply for a personal loan, input your bank information. Next, complete an application.

Step 6: Upon approval, the funds will be transferred right away to the bank account you provide.

Low Credit Score Loan Apps Benefit

- In India, you can apply for a loan from any location at any time.

- The NBFC submits these loan applications with low CIBIL scores, which the RBI approves.

- Anyone from any profession can apply for these personal loans.

- You can get unsecured personal loans with these low credit score loans without putting up any security or guarantee.

- Most of the time, your Adhaar and Pan Card KYC credentials can be used as collateral for personal loans.

- A maximum loan amount of Rs 5,00,000 is available to you.

- It won’t take longer than five minutes to apply for one of these loans.

- With just a single click and from the comfort of your home, you may apply for these loans without any bother at all by completing KYC.

Pros And Cons Best Loan App For low Credit Score

Pros of Using a Loan App for Low Credit Score:

Accessibility: Loan apps are often more accessible than traditional lenders, providing quick and convenient access to funds, which can be crucial in emergencies.

Flexible Terms: Some loan apps offer flexible repayment terms, allowing borrowers to tailor the loan duration and amount based on their financial capabilities.

Credit Building Opportunities: Certain loan apps may report on-time payments to credit bureaus, providing an opportunity for individuals with low credit scores to improve their creditworthiness.

Online Convenience: The entire loan process, from application to approval and repayment, can be done online, offering convenience to users who prefer managing their finances digitally.

Variety of Options: There are various loan apps available, each with different features and offerings, allowing borrowers to choose the one that best suits their needs.

Cons of Using a Loan App for Low Credit Score:

High Interest Rates: Due to the increased risk associated with low credit scores, many loan apps charge higher interest rates, potentially making the overall cost of borrowing expensive.

Limited Loan Amounts: Individuals with low credit scores may qualify for smaller loan amounts compared to those with higher creditworthiness.

Fees and Charges: Some loan apps may have hidden fees or charges, impacting the total cost of the loan. It’s essential to carefully review the terms and conditions.

Risk of Predatory Lending: Borrowers need to be cautious of predatory lending practices, as some unscrupulous lenders may take advantage of individuals with low credit scores.

Not a Long-Term Solution: Loans from apps are typically short-term solutions. Depending on them regularly may not address the underlying financial challenges contributing to a low credit score.

Privacy Concerns: Sharing personal and financial information with online platforms can pose privacy concerns. It’s crucial to choose reputable apps with strong security measures.

Conclusion Best Loan App For low Credit Score

In conclusion, careful evaluation of a number of aspects is necessary when choosing the best loan app for those with low credit scores. Even while these apps provide easily accessible and practical options for people in urgent need of money, it’s important to thoroughly consider the benefits and drawbacks. The advantages include selections galore, flexibility in terms of payment, chances to establish credit, ease of use online, and accessibility. The disadvantages, on the other hand, point out possible downsides such exorbitant interest rates, small loan amounts, fees and levies, the possibility of predatory lending, and the transient nature of these solutions.

Users ought to be cautious, carefully read the terms and conditions, and give preference to trustworthy programmes with open policies. It’s also a good idea to look into alternate possibilities like community banks or credit unions in your area. Individual financial circumstances ultimately determine which loan app is ideal for people with low credit scores, and users are urged to make selections that will contribute to their long-term financial security. Despite having a difficult credit history, getting financial counsel and using these tools sensibly might help you have a more stable and secure financial future.

FAQ Best Loan App For low Credit Score

What is a loan app for a low credit score?

A loan app for a low credit score is a mobile application that offers financial solutions, including loans, to individuals with less-than-ideal credit histories. These apps often provide quick access to funds, but they may come with higher interest rates due to the increased risk associated with low credit scores.

How do I choose the best loan app for a low credit score?

To choose the best loan app, consider factors such as interest rates, fees, loan terms, accessibility, and the app’s reputation. Read user reviews, check for transparent terms and conditions, and compare multiple apps to find one that aligns with your financial needs.

What are the risks of using a loan app for a low credit score?

Risks include higher interest rates, potential fees, the risk of predatory lending, and the short-term nature of these loans. Users should be cautious about privacy and security issues and carefully review the terms to avoid any hidden charges.

Are there alternatives to loan apps for low credit scores?

Yes, alternatives include local credit unions, community banks, and credit builder programs. These options may offer more personalized and affordable solutions for individuals looking to improve their creditworthiness.

How quickly can I get funds from a loan app?

Loan app processing times vary, but many offer quick approval and disbursement processes. Some apps provide instant decisions and fund transfers, making them suitable for urgent financial needs.

Are loan apps for low credit scores safe?

Reputable loan apps prioritize user security and privacy, employing encryption measures and adhering to strict data protection standards. Always choose apps with positive user reviews and transparent privacy policies to ensure safety.