Best High Yield Savings Account there will be a number of financial institutions providing competitive rates and features, and the market for high-yield savings accounts will still be changing. Apex High-Yield Savings Account is one notable choice that always attracts notice due to its alluring yields and customer perks.

Apex, which is well-known for its above-average annual percentage yield (APY) and low costs, offers depositors a safe and secure platform to manage their assets. Its powerful mobile app and user-friendly UI also make managing finances a breeze. For those looking to maximize their investments in the ever-changing world of finance, the Apex High-Yield investments Account is a great option because of its attractive interest rate and dedication to openness and dependability.

How To Choose Best High Yield Savings Account?

To make sure the greatest high-yield savings account fits your financial goals and tastes, it’s important to carefully analyze a number of important aspects. This thorough guide will assist you in making an informed choice:

Interest Rates (APY): Seek out accounts with the highest yield, measured as an annual percentage. To optimize your profits, compare rates offered by several banks or financial organizations.

Fees: Verify whether the account has any monthly maintenance fees, transaction fees, or minimum balance requirements. Choose accounts with low fees or ones that, under certain circumstances, don’t charge fees.

Minimum Balance Requirements: Determine Check to See If There Is a Minimum Balance Needed to Open or Maintain the Account. Select an account that best fits your financial circumstances in terms of minimum balance requirements.

Accessibility: Think about how easily you can access your money. Make sure the savings account permits simple withdrawals via in-person transactions, smartphone apps, internet transfers, and ATMs.

- Advertisement -

FDIC or NCUA Insurance: Check if the savings account is covered by the National Credit Union Administration (NCUA) for credit unions or the Federal Deposit Insurance Corporation (FDIC) for banks. In the event that the institution collapses, this insurance covers your savings up to the maximum permitted amount.

Customer Service: Assess the level of customer service that the credit union or bank offers. Search for organizations that offer courteous customer service across a variety of platforms, including live chat, email, and phone.

Here Is List of The Best High Yield Savings Account

- Synchrony Bank High Yield Savings

- Radius Bank

- SoFi

- BMO Bank

- BrioDirect

- CIT Bank

- Bask Bank

- IDFC Bank

- Jenius Bank

- TAB Bank

- Ally Bank

- American Express National Bank

- Capital One 360

- Synchrony Bank

- HSBC Direct Savings

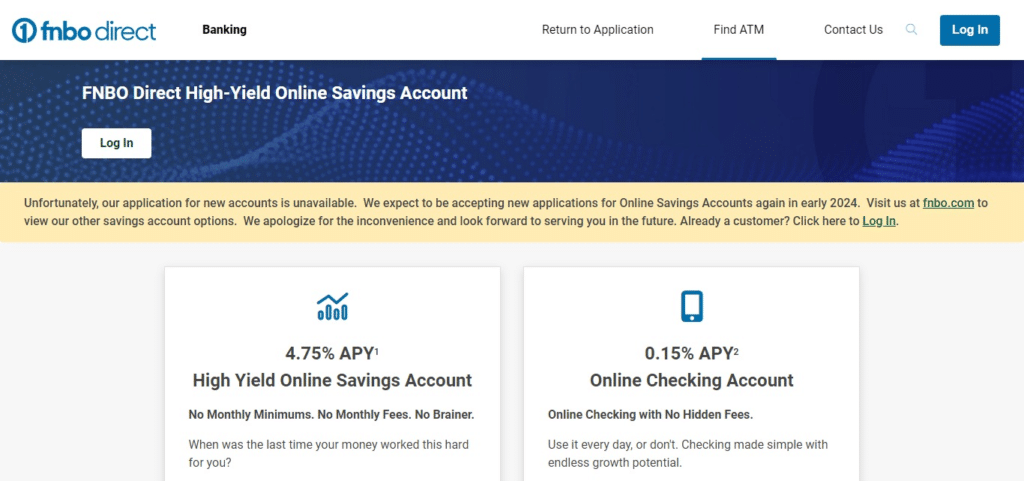

- FNBO Direct

- Sallie Mae Bank

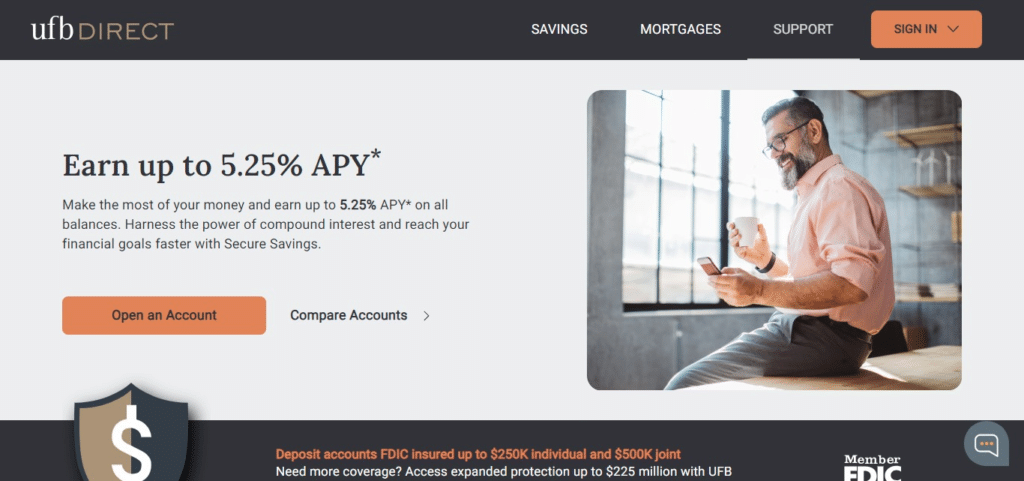

- UFB Direct

- Axos Bank

- TIAA Bank

- PNC Bank

- Wells Fargo

- Bank of America

- Chase Bank

- TD Bank

- U.S. Bank

- Charles Schwab Bank

- BBVA

- CIBC Bank USA

- Varo Bank

30 Best High Yield Savings Account In 2024

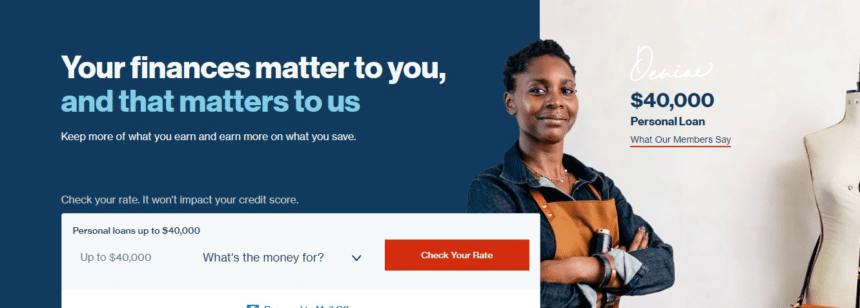

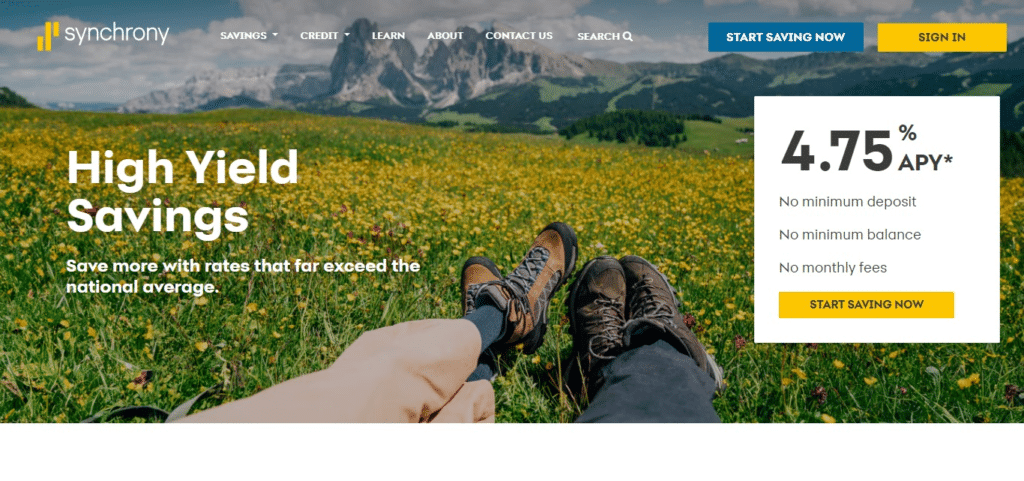

1.Synchrony Bank High Yield Savings

When it comes to high-yield savings accounts, Synchrony Bank’s High Yield Savings account is among the greatest choices. With its competitive interest rates and no monthly fees, it offers a compelling alternative for anyone who want to efficiently build their assets. The online and mobile banking services offered by Synchrony Bank make managing your money easy and accessible from any location.

In addition, the account is FDIC-insured up to the highest permitted amount, giving you financial protection and peace of mind. Synchrony Bank’s High Yield Savings account is a great option for savers looking to optimize their earnings without compromising convenience since it delivers a compelling combination of high yields and accessibility, whether you’re saving for short-term goals or creating an emergency fund.

2.Radius Bank

Among high-yield savings options, Radius Bank’s High Yield Savings account stands out as one of the best. It offers a competitive annual percentage yield (APY) and no monthly maintenance fees, making it a great option for anyone who want to increase their investments. Radius Bank’s dedication to technical innovation guarantees smooth mobile and online banking interactions, enabling users to conveniently and easily manage their funds.

Additionally, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the protection and safety of deposited money. Radius Bank’s High Yield Savings account offers a tempting blend of high yields and accessibility, making it a top choice for savers looking to maximize their savings strategy, whether they are saving for immediate needs or accumulating an emergency fund.

3.SoFi

In the world of high-yield savings, SoFi’s High Yield Savings account is considered one of the best. For those wishing to increase their funds effectively, it offers an alluring prospect with an appealing APY and no fees. Customers may conveniently access their accounts from anywhere at any time thanks to SoFi’s dedication to innovation, which is evident in both its online and mobile banking systems.

Additionally, SoFi places a high priority on security and client happiness. To that end, it provides services like FDIC insurance up to the maximum permitted amount, which guarantees the protection of deposited assets. SoFi’s High Yield Savings account is a great option for savers looking to optimize their earnings without sacrificing accessibility, whether they are saving for short-term objectives or creating an emergency fund. It offers an appealing combination of high rates and accessibility.

4.BMO Bank

Among high-yield savings options, BMO Bank’s High Yield Savings Account is a standout choice. It’s a good option for anyone who want to make the most of their savings because of its low fees and excellent interest rates. Easy access to account information and transactions is provided by BMO Bank’s user-friendly online and mobile banking systems, which demonstrate the bank’s dedication to customer satisfaction.

In addition, the account is insured by the FDIC up to the maximum amount permitted, giving consumers confidence about the security and safety of their money. BMO Bank’s High Yield Savings Account is a popular option for savers aiming to maximize their savings since it provides a strong combination of high yields and accessibility, which is ideal for those with short-term or long-term financial goals.

5.BrioDirect

When it comes to high-yield savings alternatives, BrioDirect’s High Yield Savings Account stands out as a top choice. It is a compelling option for people looking to optimize their savings potential because it has a competitive annual percentage yield and no monthly fees. BrioDirect’s user-friendly online and mobile banking solutions demonstrate their devotion to convenience by enabling consumers to conveniently manage their funds from any location.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the protection and safety of deposited money. BrioDirect’s High Yield Savings Account offers a tempting combination of high rates and accessibility, making it a top option for savers looking to maximize their savings strategy without compromising ease of use or security, regardless of their long-term or short-term financial ambitions.

6.CIT Bank

Among high-yield savings choices, CIT Bank’s High Yield Savings Account is a standout option. With its affordable interest rates and lack of monthly costs, it offers a compelling chance for people trying to increase their savings quickly. The user-friendly online and mobile banking systems of CIT Bank demonstrate the bank’s dedication to providing excellent customer service by providing easy access to account information and transaction history.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. The CIT Bank High Yield Savings Account is a top option for savers looking to maximize their savings strategy while emphasizing ease and security. It offers a strong combination of high yields and accessibility, making it suitable for both short-term and long-term financial plans.

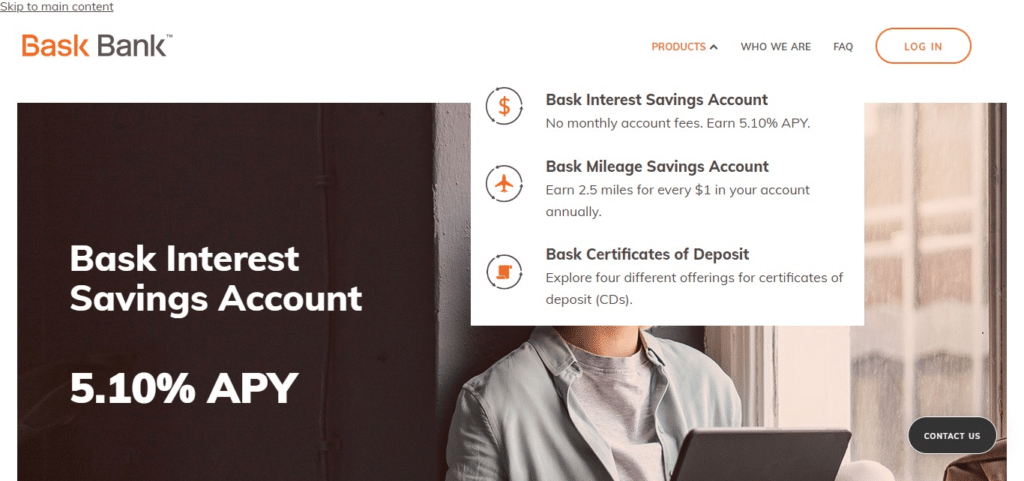

7.Bask Bank

The High Yield Savings Account offered by Bask Bank is regarded by many as one of the best choices available for high-yield savings. For those wishing to optimize their savings, it offers an alluring option with attractive interest rates and no monthly fees. Bask Bank’s commitment to customer pleasure is demonstrated by the ease with which its user-friendly mobile and internet banking platforms offer transactions and account management features.

Additionally, the account is insured by the FDIC up to the highest permitted amount, guaranteeing the protection and safety of deposited money. Savers who want to maximize their savings strategy will find that Bask Bank’s High Yield Savings Account offers a compelling combination of high yields and accessibility, making it a great option for both short-term and long-term financial objectives.

8.IDFC Bank

In the world of high-yield savings, IDFC Bank’s High Yield Savings Account stands out thanks to its competitive interest rates and abundance of advantages. With no fees and no minimum balance limitations, it offers people a compelling chance to efficiently build their money. IDFC Bank places a high priority on customer convenience by providing simple access to account information and transactions from any location through its user-friendly mobile and internet banking systems.

In addition, the account is FDIC-insured and supported by strong security protocols, guaranteeing the protection of deposited money. The IDFC Bank High Yield Savings Account is a great option for savers who want to optimize their savings strategy with peace of mind, as it offers a compelling combination of high yields and accessibility, regardless of whether they are saving for short-term goals or long-term financial ambitions.

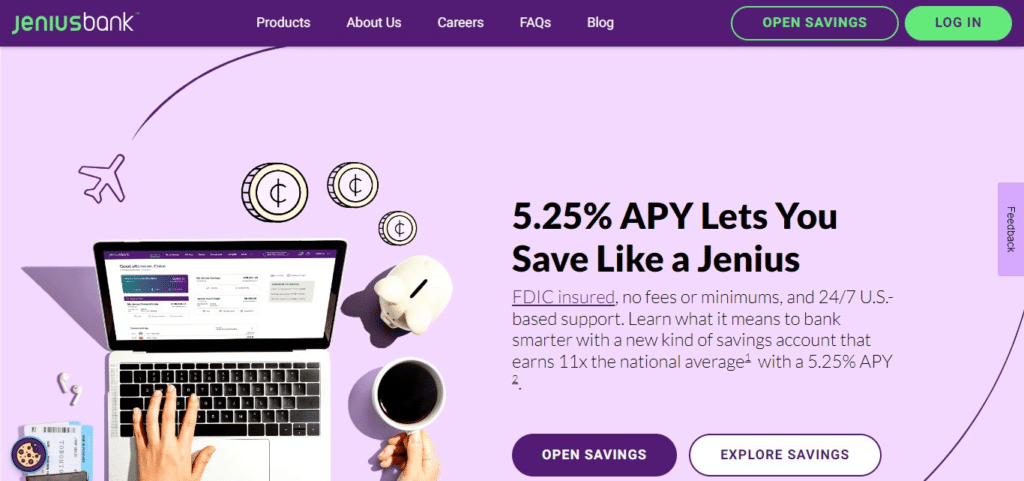

9.Jenius Bank

Among the various high-yield savings alternatives available, Jenius Bank’s High Yield Savings Account is a standout option. With its array of cutting-edge features and reasonable interest rates, it’s a great option for people looking to save as much money as possible. Jenius Bank’s user-friendly mobile banking app makes it easy to access account management features and conduct transactions, demonstrating the bank’s dedication to satisfying its customers.

The account also has strong security features and is protected by FDIC insurance, which guarantees the protection of deposited money. Jenius Bank’s High Yield Savings Account provides the ideal balance of high returns and a user-friendly banking experience, making it a favorite option for savers looking to maximize their savings for both short-term and long-term financial objectives.

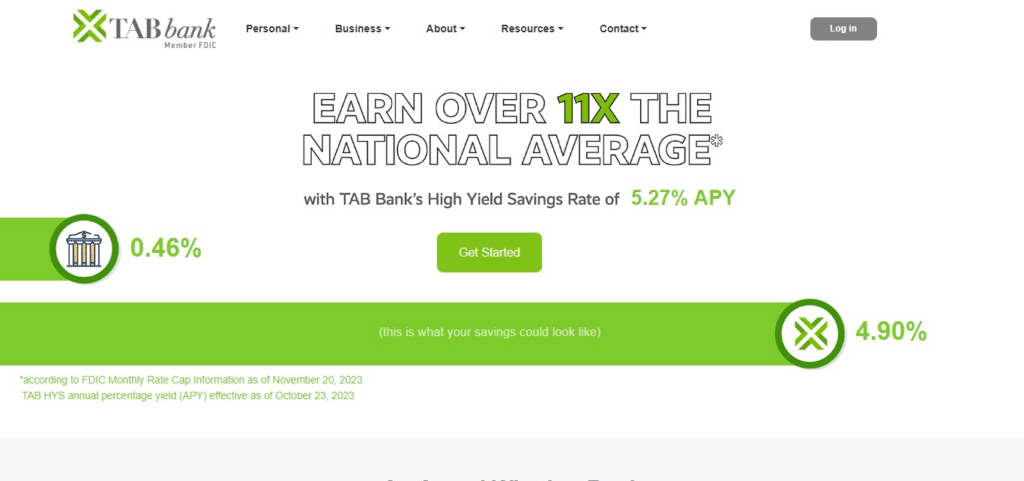

10.TAB Bank

One of the best choices available for high-yield savings is the TAB Bank High Yield Savings Account. With its competitive interest rates and no monthly fees, it offers a compelling alternative for anyone who want to efficiently build their assets. TAB Bank has demonstrated its dedication to customer satisfaction by offering simple access to account information and transactions through its user-friendly online and mobile banking systems.

In addition, the account is protected from loss and theft of deposited funds by FDIC insurance up to the highest permitted amount. TAB Bank’s High Yield Savings Account is a popular option for savers looking to maximize their savings strategy since it offers a strong blend of high yields and accessibility, which is ideal for those with short-term or long-term financial goals.

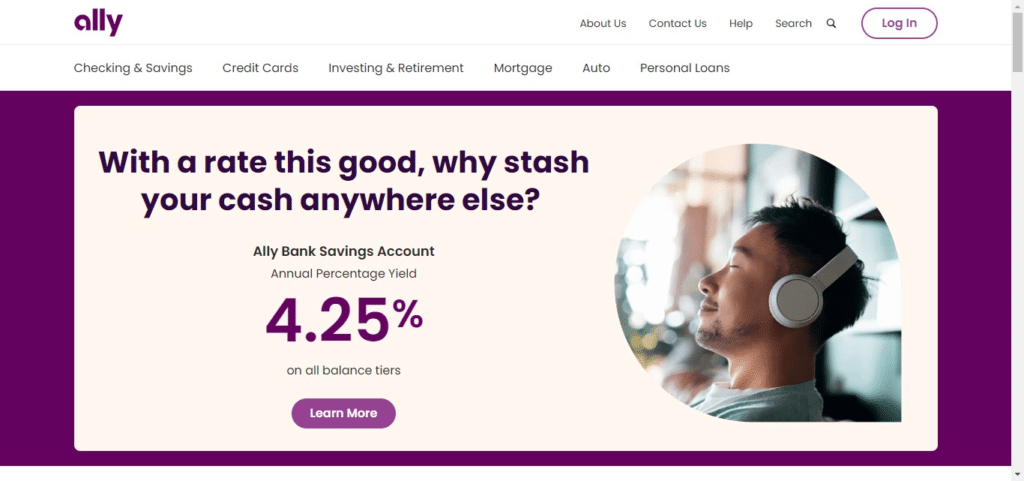

11.Ally Bank

Ally Bank’s High Yield Savings Account is widely regarded as one of the premier options in the landscape of high-yield savings. With competitive interest rates and no monthly fees, it offers an attractive opportunity for individuals aiming to maximize their savings potential. Ally Bank’s commitment to customer satisfaction is evident through its user-friendly online and mobile banking platforms, which provide convenient access to account management tools and transactions.

Additionally, the account benefits from FDIC insurance up to the maximum allowable limit, ensuring the safety and security of deposited funds. Whether saving for short-term goals or long-term financial aspirations, Ally Bank’s High Yield Savings Account provides a compelling combination of high returns and accessibility, making it a preferred choice for savers looking to optimize their savings strategy with peace of mind and convenience.

12.American Express National Bank

The High Yield Savings Account offered by American Express National Bank is regarded by many as one of the best options available for high-yield savings. With no monthly fees and competitive interest rates, it’s an alluring option for people who want to save money effectively. The user-friendly online and mobile banking systems of American Express National Bank, which offer convenient access to account information and transactions, are indicative of the bank’s dedication to ensuring customer happiness.

Additionally, the account is insured by the FDIC up to the highest permitted amount, guaranteeing the protection and safety of deposited money. The American Express National Bank’s High Yield Savings Account is a popular option for savers who want to maximize their savings strategy while emphasizing convenience and security, regardless of whether they are saving for short-term objectives or long-term financial plans. It offers a compelling combination of high returns and accessibility.

13.Capital One 360

The High Yield Savings Account from Capital One 360 is regarded by many as one of the best choices available for high-yield savings. With no monthly fees and competitive interest rates, it’s a great option for people who want to save as much money as possible. Capital One 360’s commitment to client pleasure is demonstrated by its easy-to-use online and mobile banking systems, which provide quick access to transaction and account information.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. The Capital One 360 High Yield Savings Account is a popular option for savers who want to confidently and easily optimize their savings strategy. It offers a strong combination of high returns and accessibility, making it suitable for both short-term and long-term financial plans.

14.Synchrony Bank

Many people consider Synchrony Bank’s High Yield Savings Account to be among the best available options in the high-yield savings market. With its low interest rates and lack of monthly fees, it offers a compelling alternative for people looking to optimize their investments. Easy access to account information and transactions is made possible by Synchrony Bank’s user-friendly online and mobile banking systems, which demonstrate the bank’s dedication to customer satisfaction.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. The High Yield Savings Account from Synchrony Bank is a popular option for savers who want to maximize their savings strategy since it offers a strong blend of high yields and accessibility, regardless of their long-term or short-term financial objectives.

15.HSBC Direct Savings

HSBC Direct Savings stands out as one of the top choices in the realm of high-yield savings accounts. Offering competitive interest rates and no monthly fees, it presents an enticing opportunity for individuals looking to grow their savings efficiently. HSBC’s commitment to customer satisfaction is evident through its user-friendly online and mobile banking platforms, which provide convenient access to account information and transactions.

Moreover, the account benefits from FDIC insurance up to the maximum allowable limit, ensuring the safety and security of deposited funds. Whether saving for short-term goals or long-term financial plans, HSBC Direct Savings offers a compelling combination of high returns and accessibility, making it a preferred choice for savers seeking to optimize their savings strategy with confidence and ease.

16.FNBO Direct

The High Yield Savings Account from FNBO Direct is regarded by many as one of the best choices available for high-yield savings. With no monthly fees and competitive interest rates, it’s a great option for people who want to save as much money as possible. Easy access to account information and transactions is provided by FNBO Direct’s mobile and internet banking systems, which demonstrate the company’s dedication to providing excellent client service.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. The High Yield Savings Account from FNBO Direct is a top option for savers looking to maximize their savings strategy since it offers a strong blend of high yields and accessibility, whether they are saving for immediate needs or long-term financial ambitions.

17.Sallie Mae Bank

When it comes to high-yield savings alternatives, Sallie Mae Bank’s High Yield Savings Account is a model option. With its low interest rates and lack of monthly fees, it offers a compelling alternative for people looking to optimize their investments. Sallie Mae Bank’s user-friendly online and mobile banking tools make it simple to obtain account information and conduct transactions, demonstrating the bank’s dedication to customer satisfaction.

Furthermore, the account is protected by FDIC insurance up to the highest permitted amount, guaranteeing the security and safety of money deposited. The Sallie Mae Bank High Yield Savings Account is a popular option for savers trying to maximize their savings plan since it provides a strong combination of high yields and accessibility, regardless of the saver’s short- or long-term financial objectives.

18.UFB Direct

One of the best options available for high-yield savings in the market is without a doubt UFB Direct’s High Yield Savings Account. With no monthly fees and competitive interest rates, it’s an alluring option for people who want to save money effectively. UFB Direct’s user-friendly online and mobile banking platforms make it easy to access account information and transactions, demonstrating their dedication to customer pleasure.

Additionally, the account is insured by the FDIC up to the highest permitted amount, guaranteeing the protection and safety of deposited money. UFB Direct’s High Yield Savings Account is a popular option for savers looking to maximize their savings strategy since it provides a strong blend of high yields and accessibility, regardless of the saver’s long-term or short-term financial aspirations.

19.Axos Bank

When it comes to high-yield savings alternatives, the High Yield Savings Account from Axos Bank is considered to be among the best. With no monthly fees and competitive interest rates, it’s a great option for people who want to save as much money as possible. Axos Bank’s user-friendly online and mobile banking platforms make it easy to access account information and transactions, demonstrating the bank’s dedication to customer satisfaction.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. Axos Bank’s High Yield Savings Account is a popular option for savers looking to maximize their savings since it offers a strong combination of high yields and accessibility, making it suitable for both short-term and long-term financial plans.

20.TIAA Bank

The High Yield Savings Account offered by TIAA Bank is regarded by many as one of the best choices available for high-yield savings. With no monthly fees and competitive interest rates, it’s an alluring option for people who want to save money effectively. TIAA Bank’s dedication to meeting customer needs is demonstrated by the ease with which account information and transactions can be accessed via its user-friendly mobile and internet banking systems.

Additionally, the account is insured by the FDIC up to the highest permitted amount, guaranteeing the protection and safety of deposited money. The High Yield Savings Account from TIAA Bank is a popular option for savers looking to maximize their savings strategy because it provides a strong blend of high yields and accessibility, whether they are saving for long-term financial plans or short-term objectives.

21.PNC Bank

When it comes to high-yield savings alternatives, PNC Bank’s High Yield Savings Account is regarded as one of the best. It offers a variety of advantages, including low interest rates, making it a compelling option for anyone trying to optimize their investments. PNC Bank’s commitment to client pleasure is demonstrated by its easy-to-use online and mobile banking platforms, which provide quick access to transaction and account information.

In addition, the account is insured by the FDIC up to the maximum amount permitted, guaranteeing the security and safety of money deposited. PNC Bank’s High Yield investments Account offers a tempting blend of high yields and accessibility, making it a top option for savers looking to maximize their investments, regardless of their long-term or short-term financial ambitions.

22.Wells Fargo

Customers may save money with Wells Fargo’s High Yield Savings Account, which comes with a number of practical features and excellent interest rates. Although Wells Fargo’s High Yield Savings Account may not always provide the best yields when compared to specialized high-yield savings institutions, it is still a dependable choice for people looking for a dependable banking connection.

Customers can easily manage their funds with no monthly service fees and the ability to link to other Wells Fargo accounts for simple transfers. Furthermore, Wells Fargo provides accessibility and convenience for account holders through its wide branch network and strong online and mobile banking systems. Wells Fargo’s High Yield Savings Account is a good option due to its dependability and accessibility, even though the interest rates aren’t always the best.

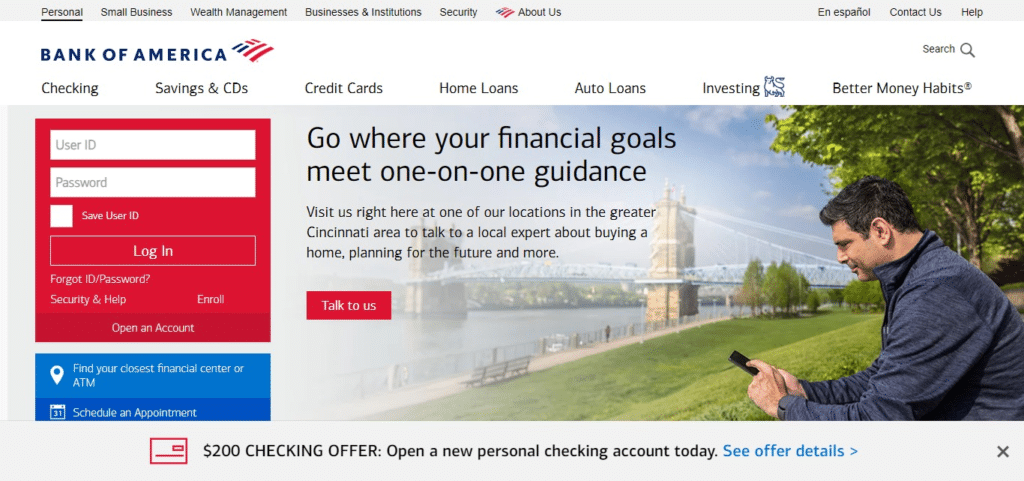

23.Bank of America

Bank of America’s High Yield Savings Account provides customers with a secure and convenient way to save while earning competitive interest rates. Although Bank of America may not always offer the highest yields compared to specialized high-yield savings institutions, its High Yield Savings Account offers stability and accessibility. With no monthly maintenance fees and the option to link to other Bank of America accounts for easy transfers, customers can manage their savings effectively.

Additionally, Bank of America’s widespread network of branches and robust online and mobile banking platforms ensures that customers can access their funds and track their savings goals with ease. While the interest rates may not always be the highest available, Bank of America’s High Yield Savings Account remains a reliable option for individuals seeking a trusted banking relationship and convenient savings solutions.

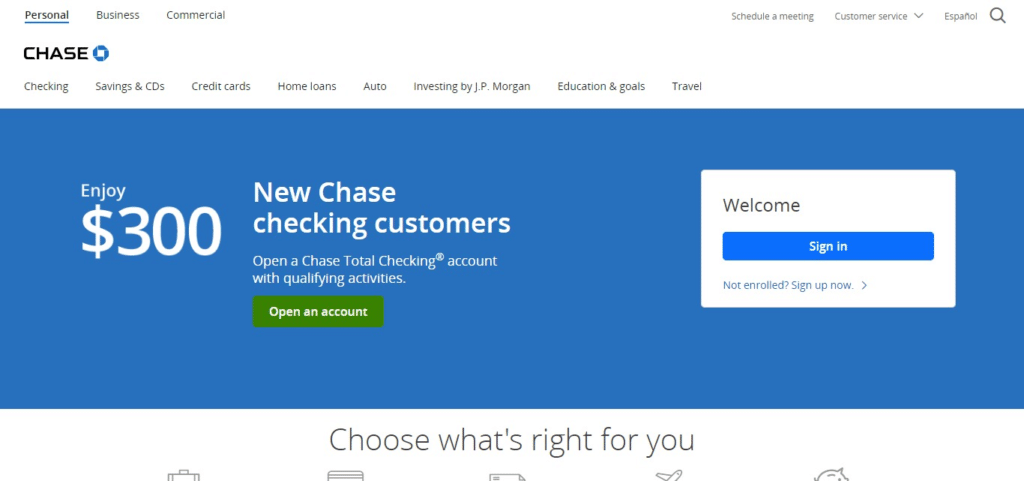

24.Chase Bank

With competitive interest rates, Chase Bank’s High Yield Savings Account offers its customers a dependable and easy method to save money. The High Yield Savings Account from Chase Bank provides accessibility and reliability, even though it might not always offer the maximum rewards when compared to specialized high-yield savings institutions. Customers may effectively manage their money with no monthly fees and the flexibility to link to other Chase accounts for smooth transfers.

Additionally, clients can easily access their assets and monitor their savings objectives thanks to Chase’s wide branch network and strong online and mobile banking systems. For those looking for a convenient and well-known banking relationship, Chase Bank’s High Yield Savings Account is still a reliable choice, even though the interest rates aren’t always the best.

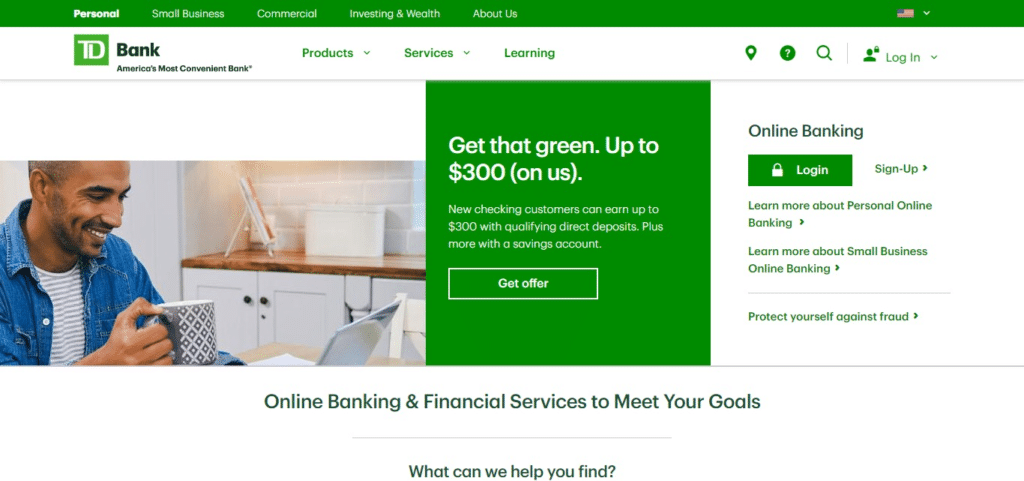

25.TD Bank

It’s possible that TD Bank doesn’t give a conventional “High Yield” savings account on par with those offered by internet banks or other specialty lenders. Still, TD Bank has a range of savings account alternatives, including their ordinary savings account, that are suited to diverse consumer needs. Even while TD Bank’s savings accounts don’t always have the best interest rates, they nevertheless give users access to a huge branch and ATM network and the comfort of a reputable brick and mortar banking experience.

Convenient tools for tracking financial objectives and managing funds are also available on TD Bank’s online and mobile banking platforms. For anyone looking for a dependable savings solution and a traditional banking connection, TD Bank’s savings accounts offer a dependable and simple choice, even though the interest rates might not be the highest.

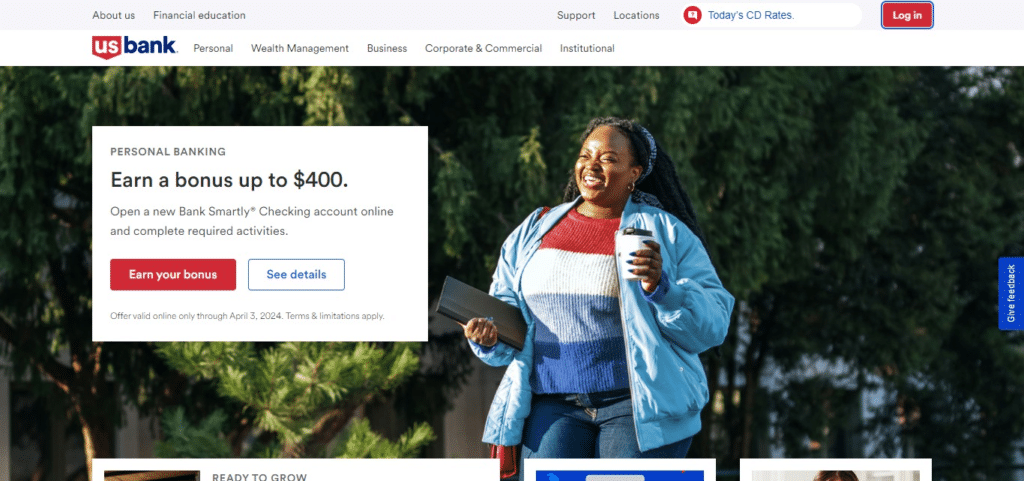

26.U.S. Bank

U.S. Bank offers customers a High Yield Savings Account as part of its suite of savings options. While U.S. Bank may not always offer the highest yields compared to specialized high-yield savings institutions, its High Yield Savings Account provides a reliable and convenient option for those looking to grow their savings with competitive interest rates. With no monthly maintenance fees and the option to link to other U.S. Bank accounts for easy transfers, customers can manage their savings effectively.

Additionally, U.S. Bank’s extensive branch network and robust online and mobile banking platforms ensure accessibility and convenience for account holders. Although the interest rates may not always be the highest available, U.S. Bank’s High Yield Savings Account remains a trusted choice for individuals seeking a familiar banking relationship and convenient savings solutions.

27.Charles Schwab Bank

The High Yield Investor Savings Account from Charles Schwab Bank gives users a competitive interest rate along with a variety of tools designed to help them achieve their savings objectives. Charles Schwab Bank’s High Yield Investor Savings Account provides stability and accessibility, even though it might not always offer the highest yields when compared to specialized high-yield savings institutions.

Customers may easily manage their savings with no monthly fees, no minimum balance requirements, and limitless worldwide ATM fee rebates. Furthermore, the internet and mobile banking platforms of Charles Schwab Bank offer practical tools for monitoring the progress of savings and handling accounts while on the road. The High Yield Investor Savings Account from Charles Schwab Bank is still a reliable choice for people looking for a savings account, even though the interest rates might not be the greatest.

28.BBVA

Customers of BBVA USA have access to a High-Interest Savings Account, which gives them the chance to increase their savings with favorable interest rates. In contrast to specialized high-yield savings institutions, BBVA’s High-Interest Savings Account may not always offer the highest rates, but it does provide accessibility and stability. Customers may effectively manage their money with no monthly service fees and the ability to link to other BBVA accounts for easy transfers.

To further improve the entire banking experience, BBVA’s user-friendly online and mobile banking platforms provide simple access to account information and transactions. While interest rates are subject to change, BBVA’s High-Interest Savings Account is a dependable option for individuals looking to maximize their savings plan because of its dedication to providing easy banking alternatives and its focus on customer satisfaction.

29.CIBC Bank USA

Customers of CIBC Bank USA can increase their savings potential with the help of a High Yield Savings Account. Even though its High Yield Savings Account offers competitive interest rates and a variety of tools to assist savings goals, CIBC Bank USA’s yields may not always be the highest when compared to specialized high-yield savings institutions. Customers may effectively manage their savings with no monthly maintenance costs and simple fund transfers between accounts.

To further improve the overall banking experience, CIBC Bank USA’s online and mobile banking systems provide easy access to account information and transactions. Interest rates can change, but CIBC Bank USA’s dedication to providing easy banking solutions and satisfying customer service makes its High Yield Savings Account a dependable choice for anybody trying to maximize

30.Varo Bank

Customers may optimize their investments with competitive interest rates and a host of practical features offered by Varo Bank’s High Yield investments Account. Varo Bank might provide better rates than more conventional brick-and-mortar banks because it is an online-only bank. Customers can save without worrying about extra expenses because there are no monthly fees or minimum balance requirements.

Customers may manage their savings anytime, anywhere with ease thanks to Varo Bank’s mobile banking app, which offers simple access to account information and transactions. Furthermore, deposited monies are safe and secure because Varo Bank’s High Yield Savings Account is FDIC-insured up to the maximum permitted amount. Varo Bank is a recommended alternative for anyone wishing to increase their savings because of its dedication to offering a high-yield savings option with user-friendly features.

Are High-Yield Savings Accounts Safe?

A safe approach to save money is through high-yield savings accounts from credit unions or banks that are NCUA or FDIC insured. These accounts are insured, respectively, by the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA), up to a predetermined amount, often $250,000 per depositor per institution.

Your hard-earned funds are protected by this insurance, which guarantees that your deposits will be covered in the event that the bank or credit union fails. It is reassuring to know that your investments are protected by federal insurance, which is why high-yield savings accounts are a dependable choice for people who want to increase their wealth while lowering risk.

How Do High-Yield Savings Accounts Work?

While they function similarly to conventional savings accounts, high-yield accounts usually have greater interest rates, which lets your money grow more quickly. This is how they function:

Deposits: Just like with a traditional savings account, you make deposits into the high-yield savings account. Depending on the bank’s policies, this first deposit may be done by cash deposit, check deposit, or electronic transfer.

Compounding: High-yield savings accounts frequently offer compound interest, which adds money to your account balance and uses that amount as a base for calculating future interest. Over time, this compounding impact accelerates the growth of your funds.

Access to Funds: You can access your funds at any time from the majority of high-yield savings accounts. Generally, you can make transfers or withdrawals over the phone, online, via the bank’s mobile app, or in person at an ATM or branch.

FDIC or NCUA Insurance: The Federal Deposit Insurance Corporation (FDIC) insures high-yield savings accounts provided by banks, whilst the National Credit Union Administration (NCUA) insures those provided by credit unions. In the event that the bank or credit union collapses, this insurance will safeguard your deposits up to a predetermined amount (usually $250,000 per depositor per institution).

Minimum amount Requirements: To avoid fees or be eligible for the quoted interest rate, certain high-yield savings accounts may have a minimum amount that you must keep up. To understand any requirements, make sure you read the terms and conditions of the account.

Fees: Although high-yield savings accounts frequently have lower fees than other account kinds, it’s important to be aware of any potential fees, such as exorbitant withdrawal or monthly maintenance costs. Seek for accounts that offer fee exemptions or reduced fees.

What Make These Best High Yield Savings Account?

Several factors contribute to making high-yield savings accounts the best options for savers:

Competitive Interest Rates: Best high-yield savings accounts offer interest rates significantly higher than those of traditional savings accounts, helping your savings grow faster over time.

Safety and Security: Accounts offered by FDIC-insured banks or NCUA-insured credit unions provide peace of mind, knowing that your deposits are protected up to the insured limit in case of bank failure.

Low Fees: The best high-yield savings accounts typically have minimal fees, such as monthly maintenance fees or excessive withdrawal fees, allowing you to maximize your earnings without sacrificing your savings to fees.

Accessibility: These accounts offer convenient access to your funds through various channels, including online banking, mobile apps, ATMs, and branches, ensuring you can manage your money whenever and wherever you need to.

No Minimum Balance Requirements: Some of the best high-yield savings accounts have no or low minimum balance requirements, making them accessible to a wide range of savers, regardless of their financial situation.

Transparency: Reputable institutions provide clear and transparent terms and conditions, making it easy for customers to understand how their accounts work and what to expect in terms of fees, interest rates, and account features.

Customer Service: Excellent customer service is another hallmark of the best high-yield savings accounts. Responsive and knowledgeable customer support can address any questions or concerns you may have, providing a positive banking experience.

Additional Features: Some high-yield savings accounts offer additional features like mobile check deposit, bill pay services, automatic savings tools, and linked checking accounts, enhancing the overall utility and convenience of the account.

Bank Reputation: Choosing a high-yield savings account from a reputable and well-established bank or credit union with a track record of financial stability and customer satisfaction adds an extra layer of confidence in your choice.

Pros And Cons Best High Yield Savings Account

Pros:

Competitive Interest Rates: High-yield savings accounts offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster over time.

Safety and Security: Accounts offered by FDIC-insured banks or NCUA-insured credit unions provide protection for your deposits up to the insured limit, ensuring the safety of your savings.

Minimal Fees: The best high-yield savings accounts typically have low or no monthly maintenance fees, helping you maximize your earnings without unnecessary charges.

Accessibility: These accounts provide convenient access to your funds through online banking, mobile apps, ATMs, and branches, allowing you to manage your money with ease.

No Minimum Balance Requirements: Some high-yield savings accounts have no or low minimum balance requirements, making them accessible to a wide range of savers.

Cons:

Fluctuating Interest Rates: Interest rates on high-yield savings accounts can change over time, potentially affecting your earnings.

Limited Transactions: Some accounts may have limitations on the number of withdrawals or transfers you can make per statement cycle, which could be restrictive for some savers.

Inflation Risk: If the interest rate on your high-yield savings account does not keep pace with inflation, your purchasing power may decrease over time.

Opportunity Cost: While high-yield savings accounts offer safety and liquidity, they typically yield lower returns compared to riskier investment options such as stocks or bonds.

Potential Fees: While many high-yield savings accounts have minimal fees, some may still charge fees for certain transactions or account maintenance, which could eat into your earnings.

Conclusion Best High Yield Savings Account

Finally, for those looking to grow their money with competitive interest rates and improved security, high-yield savings accounts are a great choice. These deposit-safe haven accounts, provided by FDIC-insured banks or NCUA-insured credit unions, guarantee protection for deposits up to the insured limit in the event of bank failure. The finest high-yield savings accounts provide an easy and effective approach to manage and save money with low fees, easy accessibility, and clear terms.

High-yield savings accounts are a useful tool for reaching short-term savings objectives, accumulating emergency cash, and diversifying a savings portfolio, despite certain drawbacks and considerations including rising interest rates and inflation threats. People may make educated selections and choose the finest high-yield savings account that fits their financial goals and tastes by carefully weighing the features and factors listed.

FAQ Best High Yield Savings Account

What is a high-yield savings account?

A high-yield savings account is a type of savings account that typically offers a higher interest rate compared to traditional savings accounts. These accounts are offered by banks and credit unions and are designed to help individuals grow their savings more quickly.

What is considered a high yield for a savings account?

The definition of a “high yield” can vary depending on market conditions, but generally, an APY (Annual Percentage Yield) of 0.50% or higher is considered competitive for a savings account.

What factors should I consider when choosing a high-yield savings account?

Factors to consider include the interest rate (APY), fees, minimum balance requirements, accessibility, customer service, account features, bank reputation, and FDIC or NCUA insurance coverage.

Can I lose money in a high-yield savings account?

Generally, you cannot lose money in a high-yield savings account in the same way you might with investments. However, if the interest rate is lower than the rate of inflation, your purchasing power could decrease over time.

Are there any fees associated with high-yield savings accounts?

Some high-yield savings accounts may have fees such as monthly maintenance fees, excessive withdrawal fees, or fees for falling below a minimum balance requirement. It’s essential to review the fee schedule before opening an account.