Best Travel Credit Card Deals Right Now: Are you equipped to embark in your next journey at the same time as incomes rewards along the way? Look no similarly than these top-notch travel credit score card offers, curated to decorate your trips and maximize your savings. Whether you’re a frequent flyer, an avid explorer of latest locations, or genuinely looking for perks on your next getaway, those credit score cards offer enticing benefits and rewards that cater to various tour styles and possibilities.

From bonus points for airline purchases to complimentary lodge remains and tour coverage perks, discover the 20 fine tour credit score card deals to be had proper now to elevate your journey revel in like by no means before.

How To Choose Best Travel Credit Card Deals Right Now?

Choosing the nice journey credit card deals requires careful attention of various factors to align along with your specific journey behavior and financial dreams. Here’s a manual to help you navigate via the alternatives and choose the appropriate tour credit score card on your desires:

Evaluate Your Travel Habits: Take inventory of your typical journey styles. Do you generally fly with a selected airline? Stay at specific resort chains? Understanding your preferences will assist narrow down cards that provide rewards and perks aligned with your way of life.

- Advertisement -

Rewards Structure: Look for playing cards that offer beneficiant rewards on your maximum frequent costs. Some playing cards offer bonus factors or miles for journey-related purchases together with flights, accommodations, and rental vehicles, even as others offer rewards on normal spending like dining, groceries, and gas. Choose a card with rewards classes that healthy your spending behavior.

Sign-Up Bonus: Consider the signal-up bonus presented by way of every card. Many journey credit score playing cards offer a considerable bonus after meeting a minimal spending requirement inside the first few months of account commencing. Look for a signal-up bonus that offers tremendous value and enhances your tour plans.

Annual Fee vs. Benefits: Assess the yearly price of every card in terms of the blessings it offers. While some cards include better annual prices, they often offer precious perks which include airport front room get entry to, tour credit, complimentary elite status, and announcement credits for travel-associated prices. Determine whether the advantages outweigh the annual fee based totally to your predicted usage.

Foreign Transaction Fees: If you frequently tour across the world, choose a card that waives foreign transaction fees. These charges can upload up quick while the use of your card abroad, so selecting a card without a foreign transaction prices can save you cash on your travels.

Travel Protections: Review the cardboard’s tour coverage and safety regulations, along with ride cancellation/interruption coverage, bags put off coverage, apartment vehicle insurance, and emergency help offerings. Ensure the cardboard gives ok insurance to your tour desires and offers peace of mind in the course of your journeys.

Flexibility in Redemption: Look for flexibility in how you could redeem your rewards. Some playing cards provide fixed-cost points or miles that can be redeemed for travel purchases at a fixed price, at the same time as others provide transferable points that may be transferred to airline and inn companions for doubtlessly higher redemption cost. Choose a card that offers redemption alternatives that align along with your options.

Customer Service and Additional Benefits: Consider the extent of customer service furnished by the card provider and any extra advantages along with concierge services, priority boarding, and buy protections. Excellent customer support can be worthwhile, specially whilst dealing with journey-associated problems or inquiries.

Here Is The List Of Best Travel Credit Card Deals Right Now

- Chase Sapphire Preferred® Card (Best Travel Credit Card Deals Right Now)

- Chase Sapphire Reserve®

- American Express® Gold Card

- The Platinum Card® from American Express

- Capital One Venture Rewards Credit Card (Best Travel Credit Card Deals Right Now)

- Citi Premier® Card

- Citi Prestige® Card

- Barclays Arrival® Premier World Elite Mastercard®

- Bank of America® Travel Rewards credit card

- Wells Fargo Propel American Express® Card (Best Travel Credit Card Deals Right Now)

- Discover it® Miles

- U.S. Bank Altitude® Reserve Visa Infinite® Card

- Marriott Bonvoy Boundless™ Credit Card

- Marriott Bonvoy Brilliant™ American Express® Card

- Hilton Honors American Express Surpass® Card (Best Travel Credit Card Deals Right Now)

- Hilton Honors American Express Aspire Card

- World of Hyatt Credit Card

- IHG® Rewards Premier Credit Card

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Premier Credit Card (Best Travel Credit Card Deals Right Now)

20 Best Travel Credit Card Deals Right Now

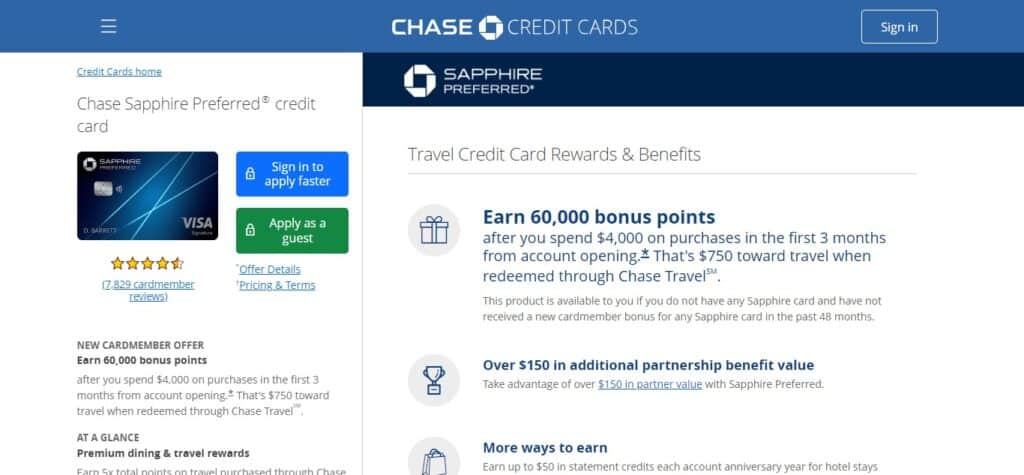

1. Chase Sapphire Preferred® Card (Best Travel Credit Card Deals Right Now)

The Chase Sapphire Preferred® Card stands as a beacon amongst travel credit card lovers, renowned for its flexible rewards and generous sign-up bonus. With this card, travelers earn 2X points on eating and tour global, making it an excellent choice for globetrotters and foodies alike. The charm of this card extends past its rewards structure; it offers treasured journey blessings together with journey cancellation/interruption coverage, number one condo vehicle insurance, and no foreign transaction expenses, making sure peace of thoughts on international adventures.

Moreover, the Chase Ultimate Rewards® software permits cardholders to redeem points for journey thru the Chase portal at an stronger fee, or switch points to plenty of airline and motel partners for probably even greater fee. For those looking for a flexible tour credit score card with robust rewards and comprehensive journey protections, the Chase Sapphire Preferred® Card remains a top contender inside the market.

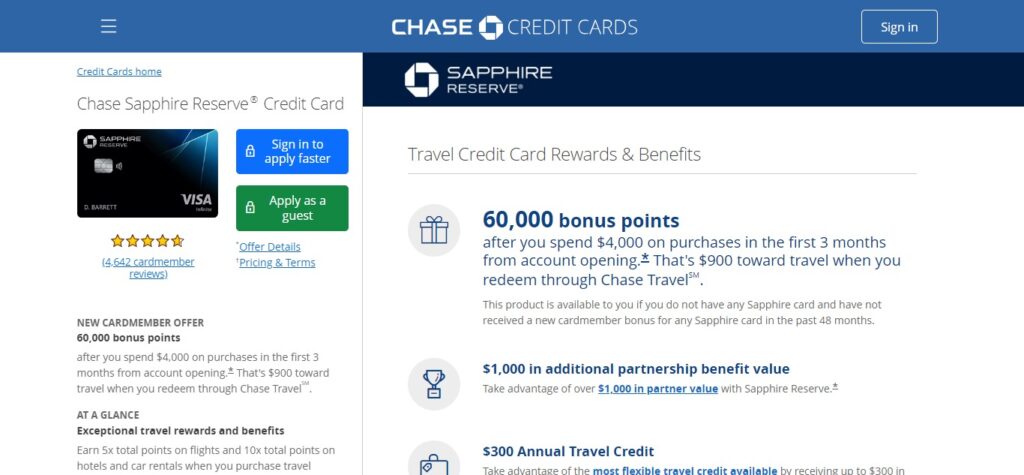

2. Chase Sapphire Reserve®

The Chase Sapphire Reserve® caters to the discerning visitor with its top class blessings and increased rewards earning potential. Boasting a graceful metallic design, this card offers an outstanding 3X points on eating and tour purchases worldwide, in conjunction with a sizable annual journey credit that offsets its better annual fee. Cardholders enjoy get right of entry to to airport lounges via the Priority Pass™ Select software, in addition to complimentary advantages like Global Entry/TSA PreCheck software fee compensation and travel insurance protections.

What sets the Chase Sapphire Reserve® apart is its expensive tour perks, including a devoted concierge provider and exceptional occasions via the Visa Infinite® program. While this card targets frequent tourists inclined to invest in top class advantages, its wealthy rewards and elite travel privileges make it a standout choice for the ones looking for a pinnacle-tier tour credit score card enjoy.

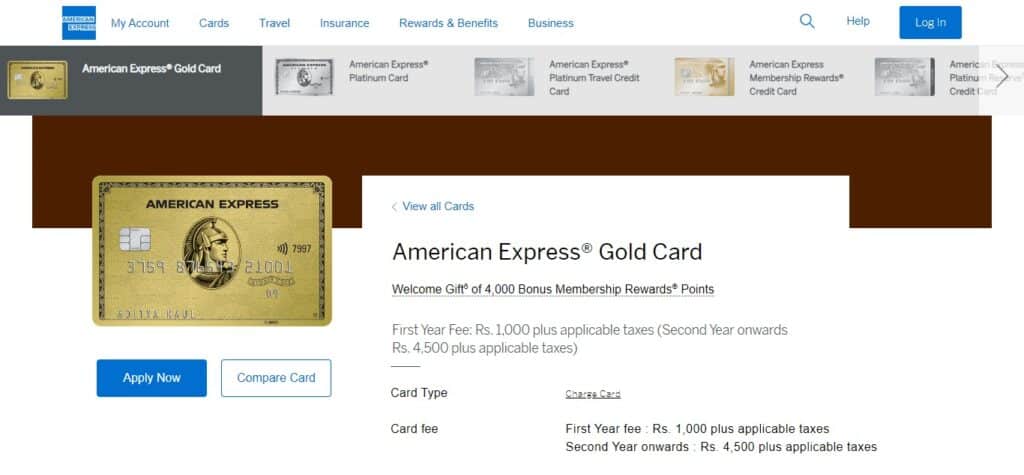

3. American Express® Gold Card

The American Express® Gold Card is a staple within the wallets of savvy vacationers, presenting sturdy rewards on dining and groceries at the side of treasured journey perks. With 4X Membership Rewards® factors at eating places worldwide and U.S. Supermarkets (on up to $25,000 in purchases in line with yr, then 1X), this card caters to epicureans and domestic cooks alike. Additionally, cardholders acquire up to $120 in annual dining credit and up to $one hundred twenty in annual Uber Cash credit, further improving the dining and transportation enjoy.

The American Express® Gold Card also provides travel advantages such as bags coverage, vehicle condo loss and harm insurance, and access to The Hotel Collection, imparting credits and perks at pick out motels. Whether indulging in culinary delights or jet-setting throughout the globe, this card elevates the journey enjoy with its moneymaking rewards and attractive blessings.

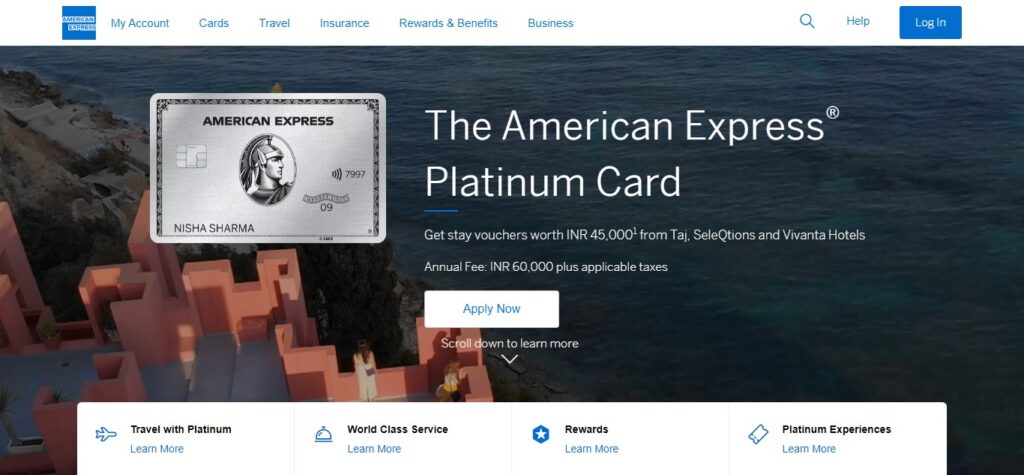

4. The Platinum Card® from American Express

The Platinum Card® from American Express stands as a image of luxury and sophistication, supplying unparalleled tour blessings and specific stories. With its hefty annual price comes a plethora of perks, consisting of get admission to to Centurion Lounges, Priority Pass™ Select membership, and complimentary elite repute with resort loyalty programs. Cardholders enjoy 5X Membership Rewards® factors on flights booked at once with airlines or thru American Express Travel, in addition to 5X factors on prepaid resorts booked through amextravel.Com.

Additionally, the Platinum Card® gives assertion credit for airline charges, Uber, and Saks Fifth Avenue purchases, along side get right of entry to to Fine Hotels and Resorts and The Hotel Collection. Beyond its tour rewards, this card presents premium way of life benefits which include Platinum Concierge service and access to one-of-a-kind events, making it a coveted choice for discerning vacationers looking for the ultimate in luxurious travel studies.

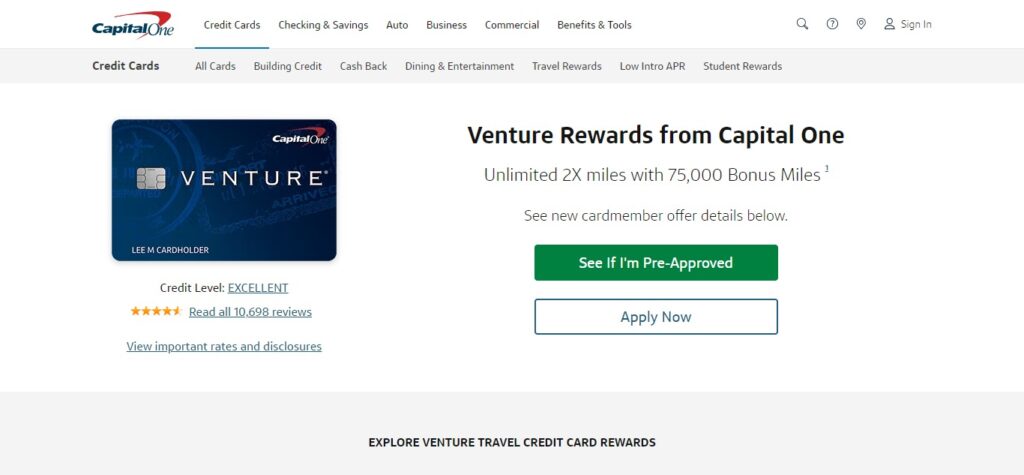

5. Capital One Venture Rewards Credit Card (Best Travel Credit Card Deals Right Now)

The Capital One Venture Rewards Credit Card appeals to tourists looking for simplicity and flexibility of their rewards program. With limitless 2X miles on each buy, this card eliminates the want to music bonus classes, making it an handy alternative for incomes rewards on everyday spending.

Cardholders experience the liberty to redeem miles for any tour purchase at a set price, or transfer miles to lots of airline and inn companions for doubtlessly extra value. Additionally, the Capital One Venture card offers a Global Entry/TSA PreCheck software rate credit and no overseas transaction costs, making it a treasured partner for worldwide journey. With its trustworthy rewards structure and flexible redemption alternatives, the Capital One Venture Rewards Credit Card provides an handy entry point into the sector of journey rewards for each occasional and pro vacationers alike.

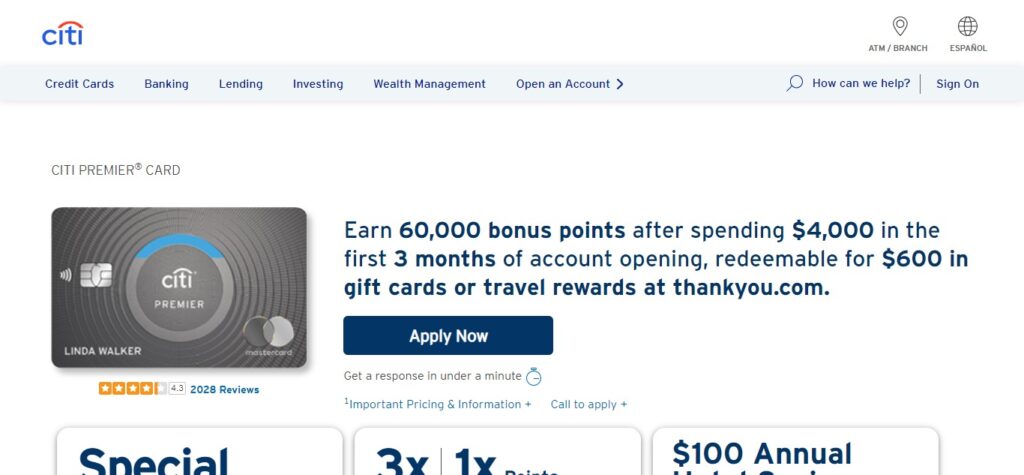

6. Citi Premier® Card

The Citi Premier® Card sticks out as a versatile journey credit score card, supplying generous rewards across a wide range of classes. With 3X points on tour including gas stations, airfare, lodges, and even dining out, in addition to 2X points on amusement and 1X on all different purchases, this card caters to diverse lifestyles and spending behavior. Cardholders also benefit from precious journey perks together with no overseas transaction costs and journey cancellation/interruption coverage.

Moreover, points earned with the Citi Premier® Card may be transferred to numerous airline companions, supplying flexibility in redemption options and doubtlessly improving their value. Whether you’re a common traveler or without a doubt experience exploring new locations, the Citi Premier® Card offers a compelling rewards shape and useful travel blessings to raise your journey.

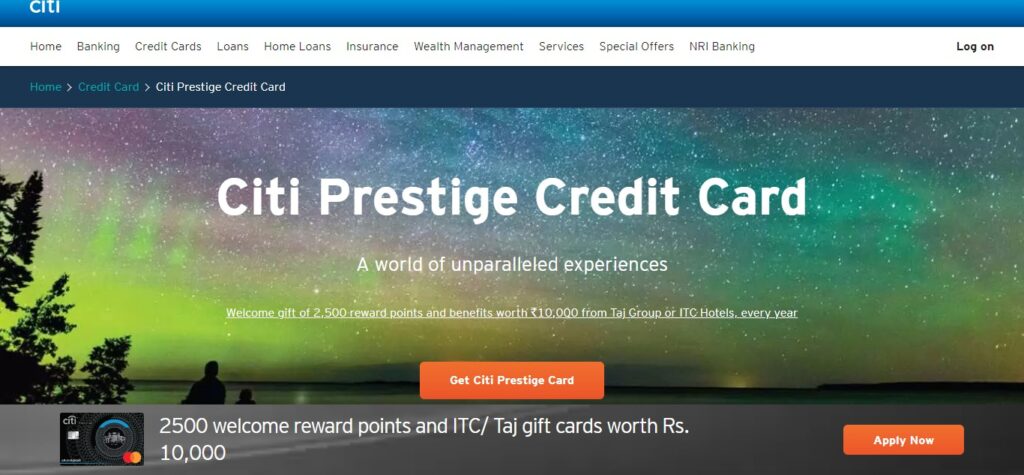

7. Citi Prestige® Card

The Citi Prestige® Card is designed for vacationers who demand the utmost luxurious and exclusivity of their credit score card enjoy. With 5X points on air travel and eating purchases, 3X factors on inns and cruise strains, and 1X on all other purchases, this card rewards each aspect of the travel enjoy. Cardholders also revel in a complimentary fourth-night resort live benefit, airport lounge get right of entry to thru Priority Pass™ Select membership, and a $250 annual journey credit that may be used for numerous journey charges.

Additionally, the Citi Prestige® Card gives treasured travel protections which includes trip cancellation/interruption coverage, ride put off insurance, and baggage postpone insurance. With its premium rewards, exceptional benefits, and comprehensive travel perks, the Citi Prestige® Card gives an remarkable revel in for discerning vacationers.

8. Barclays Arrival® Premier World Elite Mastercard®

The Barclays Arrival® Premier World Elite Mastercard® appeals to vacationers in search of simplicity and versatility in their rewards application. With limitless 2X miles on each buy, this card removes the want to music bonus classes, making it an convenient choice for earning rewards on everyday spending. Cardholders revel in the liberty to redeem miles for any tour buy at a fixed rate, or transfer miles to numerous airline and lodge partners for potentially extra cost.

Additionally, the Barclays Arrival® Premier card offers a Global Entry/TSA PreCheck utility price credit and no foreign transaction charges, making it a precious companion for global travel. With its honest rewards shape and flexible redemption alternatives, the Barclays Arrival® Premier World Elite Mastercard® provides an accessible access point into the sector of travel rewards for both occasional and seasoned travelers alike.

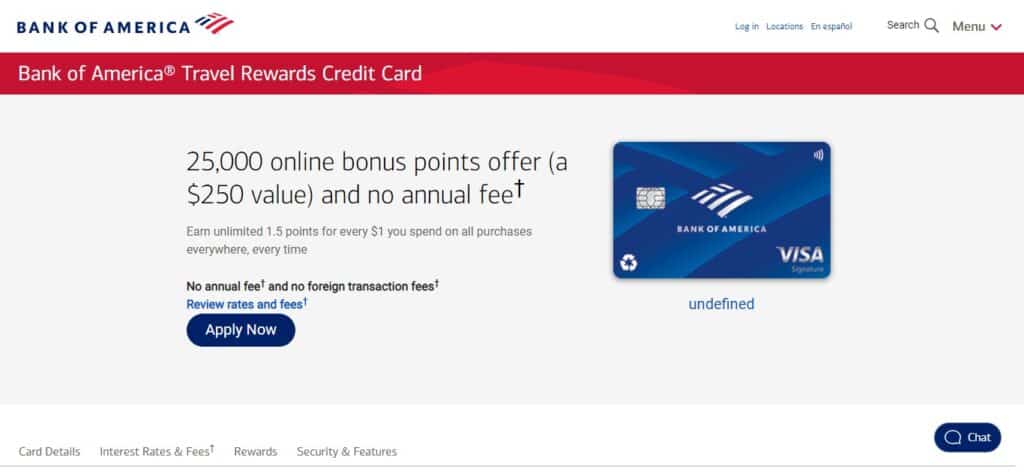

9. Bank of America® Travel Rewards credit card

The Bank of America® Travel Rewards credit card is an high-quality preference for finances-conscious travelers trying to earn rewards on their everyday purchases. With limitless 1.Five points consistent with dollar spent on all purchases, this card offers a easy and trouble-loose way to build up rewards. Cardholders also gain from no annual fee and no overseas transaction expenses, making it a great companion for global tour.

Additionally, Bank of America® Preferred Rewards contributors can earn even more points, with bonuses of as much as 75% on their rewards earnings. Points earned with the Bank of America® Travel Rewards credit score card can be redeemed for assertion credit to offset journey purchases, supplying flexibility and fee for cardholders. Whether you are making plans a weekend getaway or a dream holiday, this card offers a sincere rewards shape and practical blessings to beautify your travel enjoy.

10. Wells Fargo Propel American Express® Card (Best Travel Credit Card Deals Right Now)

The Wells Fargo Propel American Express® Card is a standout alternative for those looking for generous rewards and valuable benefits without the load of an annual rate. With 3X factors on eating, gasoline stations, rideshares, transit, flights, accommodations, homestays, and car rentals, as well as 1X points on all other purchases, this card gives robust rewards across a whole lot of spending classes. Cardholders additionally experience cellular telephone safety, no overseas transaction expenses, and access to one of a kind events and reductions through the Wells Fargo Visa Signature® Concierge Service.

Moreover, factors earned with the Wells Fargo Propel Card have flexible redemption alternatives, which includes coins returned, tour, gift cards, and more. Whether you are a common vacationer or surely looking to maximize your rewards on normal purchases, the Wells Fargo Propel American Express® Card gives a compelling combination of advantages and fee for cardholders.

11. Discover it® Miles

The Discover it® Miles card gives a unique method to journey rewards, providing cardholders with unlimited 1.5X miles on each dollar spent on all purchases, with no annual fee. What units this card aside is its terrific first-yr offer, in which Discover suits all the miles you’ve earned on the give up of your first yr, efficaciously doubling your rewards.

This characteristic makes it specifically attractive for the ones planning a considerable experience within the close to future. Additionally, Discover it® Miles cardholders advantage from no overseas transaction charges, making it a suitable accomplice for worldwide travel. With its trustworthy rewards structure, beneficiant first-12 months offer, and no annual rate, the Discover it® Miles card is an outstanding option for tourists searching for simplicity and price.

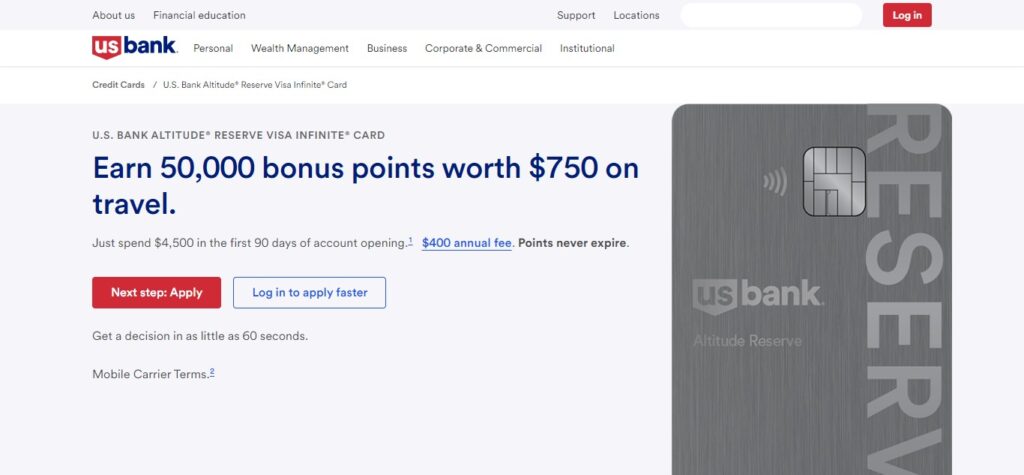

12. U.S. Bank Altitude® Reserve Visa Infinite® Card

The U.S. Bank Altitude® Reserve Visa Infinite® Card is designed for discerning tourists who call for top rate blessings and terrific rewards. With 5X points on prepaid resorts and car rentals booked at once within the Altitude Rewards Center, 3X points on journey and mobile wallet purchases, and 1X factors on all different eligible purchases, this card gives beneficiant rewards throughout diverse spending classes.

Cardholders also revel in a $325 annual travel credit score, Priority Pass™ Select membership, and reimbursement for Global Entry or TSA PreCheck utility prices. Furthermore, the U.S. Bank Altitude® Reserve Visa Infinite® Card offers precious journey protections, including journey cancellation/interruption insurance and emergency evacuation and transportation insurance. With its rich rewards, specific blessings, and comprehensive journey protections, this card is a pinnacle choice for common travelers seeking a top class credit score card enjoy.

13. Marriott Bonvoy Boundless™ Credit Card

The Marriott Bonvoy Boundless™ Credit Card is a have to-have for Marriott lovers, imparting beneficiant rewards and valuable benefits for unswerving guests. Cardholders earn 6X points in keeping with dollar spent at collaborating Marriott Bonvoy hotels, 2X factors on all other purchases, and acquire a Free Night Award (valued up to 35,000 factors) every 12 months after account anniversary. Additionally, cardholders revel in automated Silver Elite reputation, with the opportunity to earn Gold Elite reputation after spending $35,000 on purchases every account yr.

With no foreign transaction charges and tour protections together with luggage put off coverage and experience put off repayment, the Marriott Bonvoy Boundless™ Credit Card provides peace of mind and cost for frequent travelers. Whether you’re making plans a weekend getaway or an prolonged excursion, this card gives compelling rewards and advantages to beautify your Marriott experience.

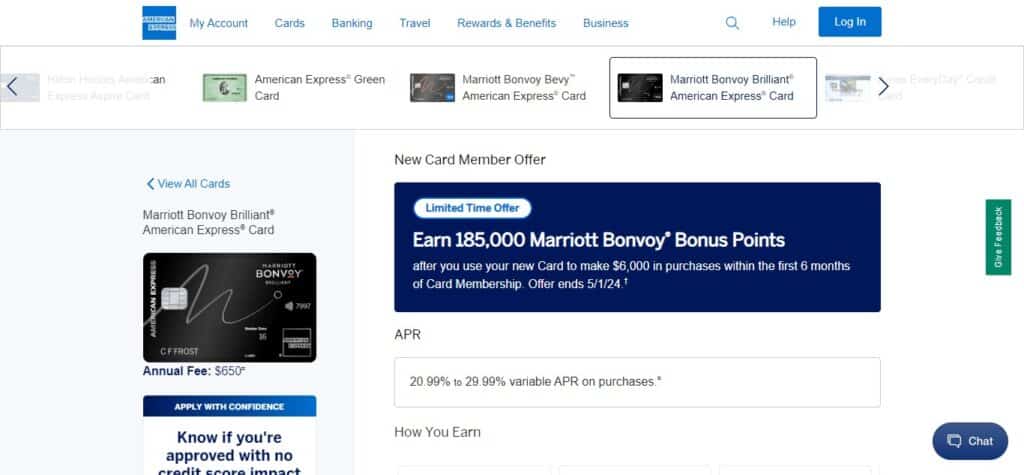

14. Marriott Bonvoy Brilliant™ American Express® Card

The Marriott Bonvoy Brilliant™ American Express® Card caters to travelers looking for luxurious and exclusivity, presenting top class rewards and unheard of advantages at Marriott Bonvoy houses worldwide. With 6X points on eligible purchases at collaborating Marriott Bonvoy motels, 3X factors at U.S. Restaurants and on flights booked immediately with airways, and 2X factors on all other eligible purchases, this card rewards each journey and normal spending. Cardholders also enjoy as much as $300 in announcement credits for eligible purchases at Marriott Bonvoy resorts, an annual Free Night Award (valued as much as 50,000 points), and complimentary Gold Elite popularity.

Additionally, the Marriott Bonvoy Brilliant™ Card gives airport lounge get entry to, TSA PreCheck or Global Entry fee repayment, and premium tour protections which includes bags coverage and ride cancellation/interruption insurance. With its costly rewards and exceptional blessings, this card gives an unmatched experience for Marriott loyalists and frequent tourists alike.

15. Hilton Honors American Express Surpass® Card (Best Travel Credit Card Deals Right Now)

The Hilton Honors American Express Surpass® Card is a standout preference for Hilton loyalists, imparting strong rewards and valuable advantages for frequent guests. Cardholders earn 12X Hilton Honors Bonus Points for every greenback of eligible purchases charged immediately with a lodge or lodge inside the Hilton portfolio, 6X points at U.S. Eating places, U.S. Supermarkets, and U.S. Gasoline stations, and 3X points on all different eligible purchases.

Additionally, the Hilton Surpass Card offers computerized Hilton Honors Gold fame, with the possibility to earn Diamond status after spending $forty,000 on purchases each calendar 12 months. With no foreign transaction charges and tour advantages such as baggage insurance and vehicle condo loss and harm coverage, this card enhances the journey revel in for Hilton lovers. Whether you are making plans a leisurely vacation or a commercial enterprise trip, the Hilton Honors American Express Surpass® Card gives rewarding benefits and tremendous value for Hilton guests.

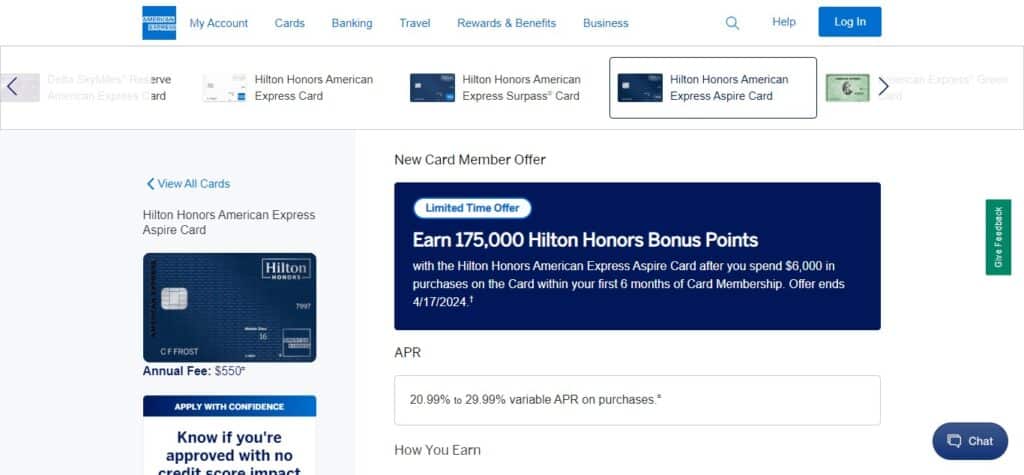

16. Hilton Honors American Express Aspire Card

The Hilton Honors American Express Aspire Card is the top of luxurious and advantages for Hilton fanatics. With this card, cardholders earn a impressive 14X Hilton Honors Bonus Points for each greenback spent on eligible purchases at participating Hilton properties, 7X factors on flights booked without delay with airways or amextravel.Com, car rentals booked without delay from pick out automobile rental organizations, and U.S. Restaurants, and 3X factors on all different eligible purchases.

Additionally, cardholders receive a complimentary Hilton Honors Diamond reputation, which includes elite blessings which include room improvements, complimentary breakfast, and executive living room get right of entry to. The card additionally gives an annual unfastened weekend night praise, up to $250 Hilton inn announcement credit, as much as $250 airline price credit score, and as much as $one hundred assets credit at Waldorf Astoria and Conrad residences. With no overseas transaction fees and journey protections like baggage insurance and vehicle condo loss and harm coverage, this card caters to tourists searching for luxurious, rewards, and distinctive blessings.

17. World of Hyatt Credit Card

The World of Hyatt Credit Card is a favourite amongst common travelers in search of top class rewards and advantages in the Hyatt surroundings. Cardholders earn 4X Bonus Points according to dollar spent at Hyatt hotels, 2X factors in line with dollar spent on eating, airline tickets purchased directly from airlines, nearby transit and commuting, and health club and fitness center memberships, and 1X point according to dollar spent on all other purchases.

Additionally, the cardboard offers a Free Night Award at a Category 1-four Hyatt motel every 12 months after the cardholder’s anniversary, automated Discoverist reputation in the World of Hyatt program, and the opportunity to earn elite repute quicker via spending thresholds. With no overseas transaction fees, journey protections, and the ability to earn factors towards elite status and free nights, the World of Hyatt Credit Card is a compelling preference for Hyatt loyalists and travelers searching out a worthwhile inn credit card.

18. IHG® Rewards Premier Credit Card

The IHG® Rewards Premier Credit Card is tailored for tourists who frequent IHG houses, providing robust rewards and treasured benefits. Cardholders earn as much as 25X factors overall consistent with dollar spent when they live at an IHG inn, 2X points at gasoline stations, grocery stores, and eating places, and 1X factor on all different purchases.

Additionally, the card gives an annual free night certificates valid at eligible IHG hotels worldwide, computerized Platinum Elite repute, a fourth night time unfastened gain on award stays of four or more nights, and a Global Entry or TSA PreCheck rate credit score. With no overseas transaction expenses and tour protections like experience cancellation/interruption coverage and bags delay coverage, the IHG® Rewards Premier Credit Card offers brilliant cost and advantages for IHG loyalists and vacationers looking for rewards for motel stays.

19. Southwest Rapid Rewards® Plus Credit Card

The Southwest Rapid Rewards® Plus Credit Card is an remarkable option for tourists who frequent Southwest Airlines, imparting beneficiant rewards and precious benefits. Cardholders earn 2X points according to greenback spent on Southwest Airlines purchases and Rapid Rewards® resort and car condo partner purchases, in addition to 1X factor per dollar spent on all other purchases.

Additionally, the card provides a signal-up bonus, anniversary bonus factors, and no blackout dates or seat restrictions while redeeming factors for flights. With blessings like no overseas transaction prices and travel protections such as luggage postpone coverage and tour coincidence coverage, the Southwest Rapid Rewards® Plus Credit Card is a stable desire for Southwest loyalists and tourists searching for rewards and advantages for flights in the United States and to choose global locations.

20. Southwest Rapid Rewards® Premier Credit Card (Best Travel Credit Card Deals Right Now)

The Southwest Rapid Rewards® Premier Credit Card caters to frequent Southwest Airlines tourists, providing stronger rewards and valuable blessings. Cardholders earn 3X factors per dollar spent on Southwest Airlines purchases, Rapid Rewards® motel and car apartment partner purchases, and 2X points in step with dollar spent on local transit and commuting, inclusive of rideshare services, transit, tolls, and parking.

Additionally, the cardboard gives a sign-up bonus, anniversary bonus points, and no blackout dates or seat regulations when redeeming factors for flights. With advantages like no foreign transaction fees and tour protections together with bags postpone insurance and journey coincidence insurance, the Southwest Rapid Rewards® Premier Credit Card is an amazing desire for Southwest loyalists and vacationers looking for more advantageous rewards and benefits for home and international flights.

Best Travel Credit Card Deals Right Now Pros & Cons

Pros

Rewards and Points: Travel credit score cards offer rewards and points that may be redeemed for various travel-related charges, which include flights, motels, rental cars, and more. These rewards can assist offset the cost of travel and offer extra perks like loose nights or upgrades.

Sign-Up Bonuses: Many tour credit cards include moneymaking signal-up bonuses, normally offered after meeting a minimum spending requirement inside a designated time frame. These bonuses can frequently be enormous and offer an exquisite incentive for new cardholders.

Travel Benefits: Travel credit score playing cards often include a range of journey blessings, consisting of travel coverage, airport living room get right of entry to, priority boarding, loose checked baggage, and declaration credit for journey prices like TSA PreCheck or Global Entry expenses.

No Foreign Transaction Fees: For common international travelers, many journey credit playing cards waive overseas transaction costs, which can shop substantial cash on purchases made overseas.

Additional Perks: Some travel credit playing cards provide additional perks together with concierge services, buy protections, prolonged warranties, and exceptional get right of entry to to activities or stories.

Cons

Annual Fees: Many travel credit score playing cards come with annual charges, that may range from slight to high. While those costs may be justified through the cardboard’s benefits and rewards, they could nevertheless represent an added expense.

Interest Rates: Travel credit score cards regularly have better hobby costs compared to different styles of credit playing cards. Carrying a stability can result in great hobby expenses that could outweigh the value of any rewards earned.

Reward Redemption Restrictions: Some journey credit cards have regulations or blackout dates when redeeming rewards, restricting flexibility in travel plans. Additionally, the value of rewards points or miles can vary primarily based on redemption alternatives and availability.

Credit Score Impact: Opening a brand new travel credit card can quickly lower your credit score score due to the credit score inquiry and new account beginning. However, responsible use of the cardboard can assist enhance your credit rating over time.

Minimum Spending Requirements: To qualify for sign-up bonuses, many journey credit score cards require cardholders to satisfy minimal spending requirements within a specified time frame. Failing to fulfill these necessities can bring about forfeiting the bonus.

Best Travel Credit Card Deals Right Now Conclusion

In end, navigating the panorama of travel credit card deals requires a radical understanding of every card’s benefits, rewards shape, expenses, and terms. While there isn’t a one-size-fits-all solution, several standout alternatives provide compelling incentives for tourists. Chase Sapphire Preferred® Card and Chase Sapphire Reserve® are praised for his or her flexible rewards and top rate travel advantages, while American Express® Gold Card and The Platinum Card® from American Express cater to luxury tourists with different perks and rewards. For those looking for simplicity and versatility, Capital One Venture Rewards Credit Card offers truthful rewards and redemption alternatives.

It’s essential to weigh the professionals and cons of each card carefully, considering elements which includes annual fees, hobby rates, reward redemption flexibility, and extra advantages. Additionally, evaluating your spending behavior, tour alternatives, and economic dreams can assist narrow down the choices and find the card that quality suits your needs.

Ultimately, the satisfactory journey credit card deal proper now relies upon on your person instances and preferences. By accomplishing thorough studies, evaluating to be had options, and knowledge your priorities, you can make an informed decision and maximize the benefits of your chosen tour credit card. Whether you prioritize earning points for flights and inns, taking part in luxury tour perks, or minimizing costs and hobby expenses, there’s a journey credit score card deal available to beautify your tour experience and assist you gain your desires.

Best Travel Credit Card Deals Right Now FAQ’s

What are tour credit score card offers?

Travel credit score card offers refer to big offers and promotions supplied by credit score card issuers specially for tour-related advantages. These offers frequently include sign-up bonuses, rewards programs tailor-made closer to travel costs, and numerous journey perks together with airport lounge access, tour coverage, and announcement credits for journey prices.

How do I locate the nice journey credit card deal for me?

Finding the first-rate journey credit card deal depends on your man or woman possibilities, journey behavior, and monetary goals. Consider factors inclusive of rewards structure, signal-up bonuses, annual expenses, journey blessings, and redemption options. Compare distinct cards, study critiques, and check how well every card aligns together with your needs.

What styles of rewards do travel credit score cards offer?

Travel credit cards usually offer rewards within the form of points or miles that can be redeemed for various journey-related fees, together with flights, resorts, rental motors, and extra. Some cards may offer coins again rewards or bendy points that can be redeemed for assertion credits or merchandise.

What are the blessings of journey credit cards?

Travel credit cards provide a range of advantages, along with sign-up bonuses, rewards on purchases, journey coverage, airport lounge get admission to, no overseas transaction fees, announcement credits for tour prices, and additional perks which include concierge services and buy protections.

Are there any drawbacks to travel credit score cards?

While travel credit score playing cards can offer treasured benefits, they will also include drawbacks along with annual prices, better hobby costs, praise redemption regulations, minimum spending necessities to qualify for sign-up bonuses, and capability impacts on credit score ratings.

How do I maximize the blessings of a journey credit score card?

To maximize the blessings of a journey credit card, make sure to use the card for eligible purchases to earn rewards, take gain of signal-up bonuses, redeem rewards for maximum price, make use of journey perks together with airport living room get entry to and travel insurance, and pay off your balance in full each month to keep away from interest costs.