Best Instant Loan App Without Salary Slip are can be very important for people who don’t have regular jobs to find the greatest immediate loan app without needing a pay stub. MoneySwift is a noteworthy alternative that provides loans without requiring a pay stub; it is an innovative financial platform. MoneySwift is available to freelancers, gig workers, and self-employed people. It uses sophisticated algorithms and other data sources to evaluate applicants’ creditworthiness. Because of the app’s user-friendly UI, users can finish the application process quickly.

For borrowers looking for quick loans without the traditional evidence of income, MoneySwift stands out as a dependable option because to its low paperwork requirements and emphasis on financial inclusion. It is significant to remember that even though the app might not request a pay stub, users must still meet specific requirements in order to be eligible for loans, indicating the platform’s dedication to ethical lending standards.

Why Should You Choose Best Instant Loan App Without Salary Slip?

Inclusive Eligibility Criteria: Alternative data sources are frequently used by instant loan applications, which do not require a pay stub to determine creditworthiness. Because of this comprehensive approach, people who earn money in nontraditional ways—like freelancers and gig workers—can be eligible for loans.

Application Process Simplified: Because these apps usually have an easy-to-use interface and require less documentation, the application process is simplified. For those who require immediate access to funds without the inconvenience of a lot of paperwork, this is useful.

- Advertisement -

Fast Approval and Payment: Removing the requirement for a pay stub helps speed up the approval procedure. Instant loan apps put efficiency first, guaranteeing that money are accepted and disbursed quickly, which qualifies them for financial emergencies.

Financial Inclusion: These apps promote financial inclusion by serving users who do not have access to standard pay stubs. They acknowledge that different people have different jobs and sources of money, therefore they make sure a wider range of people can use financial services.

Adaptability to Freelance and Self-Employed Lives: Loan applications that do not only rely on pay stubs for eligibility might be helpful to those with variable income or irregular pay schedules, which are typical in freelance or self-employment situations.

Accessible Repayment Plans: Considering their users’ diverse financial circumstances, the greatest rapid loan apps frequently provide flexible and accessible repayment plans. The borrower’s capacity to efficiently manage repayments is improved by this flexibility.

Technology-Driven Assessment: These applications evaluate an applicant’s creditworthiness based on a number of variables other than a conventional pay stub by using sophisticated algorithms and technology. This contemporary method fits with the changing nature of employment and income.

Clear and Transparent Terms and Conditions: Reputable rapid loan apps offer conditions that are both transparent and easy to understand. This openness guarantees that borrowers are aware of the conditions of the loan arrangement and gives them the ability to make educated decisions.

Customer support: is a crucial aspect of the finest rapid loan apps, offering aid and direction during the application and repayment processes. For borrowers, particularly those unfamiliar with alternative lending platforms, this assistance may be vital.

Here Is List of The Best Instant Loan App Without Salary Slip

- PaySense

- CashE

- KreditBee

- Home Credit

- Nira

- Dhani

- FlexSalary

- PayMe India

- IndiaLends

- Navi

- True Balance

- ZestMoney

- Hero FinCorp

- MoneyTap

- mPokket

- LoanTap

- EarlySalary

- Fibe

- MoneyView

- Finnable

- Privo

- LazyPay

- Bajaj Finserv

- RupeeRedee

- StashFin

- Credy

- Upwards

- SMFG Credit

- IDFC First Bank

- Fullerton India

30 Best Instant Loan App Without Salary Slip

1.PaySense (Best Instant Loan App Without Salary Slip)

PaySense is one of the greatest immediate loan apps and is well known for this function. Because of this unique feature, people who might not have a typical work structure or find it difficult to provide a pay slip will find it very appealing. PaySense uses cutting-edge technology to evaluate applicants’ creditworthiness based on a variety of criteria other than employment history.

The app simplifies the loan application process and provides fast, easy approvals, making it the perfect choice for anyone who want emergency financial support. PaySense stands out as a dependable and approachable platform for acquiring immediate loans without the onerous requirement of a pay stub because to its user-friendly layout, clear terms, and effective customer care.

2.CashE

CashE has made a name for itself as a top rapid loan app that meets each person’s distinctive demands. The unique way that CashE evaluates creditworthiness—which goes beyond conventional employment documentation—sets it apart. Because of this functionality, CashE is a desirable option for people who work in unconventional jobs or who find it difficult to provide a pay stub. The application procedure is made simpler by the app’s user-friendly design, which guarantees prompt approvals and effective disbursements.

A responsive customer support system and CashE’s dedication to open terms and conditions improve the user experience overall. Within the field of rapid loan apps, CashE stands out as a dependable and approachable option for individuals in need of immediate financial aid without the usual obstacles associated with salary.

3.KreditBee

In order to set itself apart from the competition, KreditBee has positioned itself as a premium rapid loan app. It does this by providing a simple and effective borrowing process that does not require a traditional pay stub. This special function serves a wide variety of users, such as those who have irregular work schedules or find it difficult to provide a pay stub. Modern technology is used by KreditBee to assess applicants’ creditworthiness based on a variety of factors other than employment history.

With its user-friendly layout, the app guarantees a smooth loan application procedure that results in fast approvals and payouts, making it the perfect option for people who require financial support immediately. With its simple and understandable conditions and dedication to openness, KreditBee is a reliable rapid loan app that offers a helpful alternative to people facing financial difficulties without requiring a pay stub.

4.Home Credit

A prominent leader in the field of rapid lending apps, Home Credit offers a unique benefit in that it does not require a typical pay stub to be submitted with the application. This special feature meets the needs of a diverse range of people, such as those with unusual work arrangements or trouble presenting a pay stub. Home Credit employs sophisticated evaluation techniques that take into account variables other than conventional job records when determining an applicant’s creditworthiness.

The intuitive user interface of the app guarantees a seamless and rapid loan application process, offering prompt approvals and timely payouts. Home Credit is a go-to rapid loan app for people looking for financial aid without the need for a pay stub because of its dedication to openness in terms and conditions and its attentive customer care system.

5.Nira (Best Instant Loan App Without Salary Slip)

As a top app for rapid loans, Nira has distinguished itself by doing away with the requirement for a traditional pay stub for the application procedure. For those with non-traditional job arrangements or those who find it difficult to provide a pay slip, this additional function is extremely helpful. Nira uses cutting-edge technology to evaluate applicants’ creditworthiness based on a wide range of factors other than just their job history.

The application guarantees an easy-to-use and effective loan application procedure, expediting approvals and payouts on schedule. Nira’s attractiveness as a dependable rapid lending app is increased by its dedication to clarity and openness in its terms, as well as by its attentive customer care team. In the world of rapid loan applications, Nira stands out as a practical and approachable option for people looking for financial aid without the usual wage slip criteria.

6.Dhani

One of the best applications for rapid loans is Dhani, which sets itself apart by providing a smooth borrowing process without requiring a paper pay stub. This special function serves a wide spectrum of users, including those with non-traditional work arrangements or those who have trouble supplying a pay stub. Dhani uses cutting-edge technology to assess candidates’ creditworthiness based on a variety of criteria other than employment history.

With its intuitive UI, the app guarantees a simple loan application process with fast approvals and timely disbursements. Dhani’s reputation as a trustworthy and user-friendly rapid loan app is cemented by its dedication to terms and conditions transparency and its prompt customer assistance system. Dhani stands out as a reliable option in the field of immediate loan applications for people in need of quick cash help without the usual requirements for a pay stub.

7.FlexSalary

One noteworthy benefit of FlexSalary, a well-known fast loan app, is that it does not require a standard pay stub as part of the application process. This special feature is very helpful for those whose work patterns aren’t typical or who have trouble providing a pay stub. With the use of advanced technology, FlexSalary evaluates applicants’ creditworthiness based on a wide range of factors other than traditional job histories.

With rapid approvals and prompt payouts, the app guarantees a simple and quick loan application process. FlexSalary’s reputation as a trustworthy rapid loan app is strengthened by its dedication to openness in its terms and conditions and its helpful customer service team. Within the world of rapid loan applications, FlexSalary stands out as a practical and approachable option for individuals looking for financial aid without the typical wage slip criteria.

8.PayMe India

Due to its unique approach of not requiring a traditional pay stub for the application procedure, PayMe India has become a prominent rapid lending app. This special function serves a wide range of users, including those with unusual work schedules or difficulties supplying a pay stub. Using sophisticated technology, PayMe India assesses applicants’ creditworthiness based on a wide range of factors other than just their job history. With its user-friendly interface, the app guarantees a fast and easy loan application procedure with prompt approvals and payouts.

PayMe India’s reputation as a reliable rapid loan app is strengthened by its dedication to openness in its terms and conditions and its prompt customer service. In the world of rapid loan applications, PayMe India stands out as a dependable and approachable option for individuals looking for financial aid without the typical wage slip requirements.

9.IndiaLends

IndiaLends has established itself as a top provider of rapid loans by providing a unique benefit: the loan application procedure does not require a standard pay stub. This special function meets the demands of a wide range of users, such as those who have unusual work arrangements or have trouble supplying a pay stub. IndiaLends uses sophisticated algorithms to assess applicants’ creditworthiness based on a wide range of criteria other than employment history. With its user-friendly layout, the app guarantees a quick and easy loan application procedure with timely approvals and effective disbursements.

IndiaLends’ reputation as a trustworthy instant loan app is increased by its dedication to openness in terms and conditions and its quick customer service team. When it comes to rapid loan applications, IndiaLends is a practical and approachable option for individuals looking for financial aid without having to meet traditional wage slip requirements.

10.Navi (Best Instant Loan App Without Salary Slip)

In the field of rapid lending apps, Navi has become a major player. What sets it apart is that it provides a hassle-free borrowing experience without requiring a standard pay stub. This special function serves a broad spectrum of users, including those with non-traditional work arrangements or difficulties providing a pay stub. Navi uses cutting-edge technology to evaluate applicants’ creditworthiness based on a wide range of factors other than traditional job records. The application guarantees a smooth and expedient loan application procedure, offering prompt approvals and payouts.

Navi’s reputation as a trustworthy immediate loan app is reinforced by its dedication to openness in terms and conditions and its quick customer service system. In the world of speedy loan applications, Navi stands out as a reliable and approachable option for people in need of immediate financial aid without the typical salary slip restrictions.

11.True Balance

True Balance has established itself as a well-known rapid loan app by providing a practical workaround that eliminates the requirement for a conventional pay stub throughout the application procedure. This special functionality serves a wide range of users, such as those with non-traditional work arrangements or difficulties presenting a pay stub. True Balance uses cutting-edge technology to evaluate applicants’ creditworthiness while taking into account a number of variables outside of traditional job records.

With its intuitive design, the app guarantees a smooth loan application procedure with prompt approvals and effective disbursements. True Balance’s reputation as a dependable rapid loan app is strengthened by its dedication to openness in its terms and conditions and its helpful customer service team. In the world of rapid loan applications, True Balance stands out as a reliable and approachable option for people looking for financial aid without the usual wage slip criteria.

12.ZestMoney

ZestMoney is a prominent rapid loan app that sets itself apart by providing a simple borrowing process that does not require a regular pay stub. This special function serves a wide range of users, including those who struggle to provide a pay slip or have non-traditional employment arrangements. ZestMoney evaluates applicants’ creditworthiness using sophisticated algorithms that assess a wide range of indicators beyond traditional work records.

The application guarantees a smooth and effective loan application procedure, offering prompt approvals and payouts. ZestMoney’s reputation as a trustworthy instant loan app is strengthened by its dedication to openness in terms and conditions and its quick customer service system. In the world of immediate loan applications, ZestMoney stands out as a trustworthy and approachable option for anyone looking for quick cash aid without the usual wage slip restrictions.

13.Hero FinCorp

Hero FinCorp has established itself as a major participant in the immediate loan app market by providing a unique benefit—namely, the ability to apply without requiring a regular pay stub. This special function serves a diverse range of users, such as those with non-traditional work arrangements or trouble providing a pay stub. Hero FinCorp uses state-of-the-art technology to assess applicants’ creditworthiness based on a wide range of factors that go beyond traditional job histories.

Because of the app’s user-friendly layout, loan applications are processed quickly and easily, and payments are made out effectively as well. Hero FinCorp’s reputation as a trustworthy immediate loan app is strengthened by its dedication to openness in terms and conditions and its quick customer service system. Within the world of rapid loan applications, Hero FinCorp stands out as a reliable and approachable option for people in need of financial support without the usual wage slip requirements.

14.MoneyTap

As one of the top fast lending apps, MoneyTap has made a name for itself by offering a simple and easy way to borrow money without needing a traditional pay stub. This special function serves a wide spectrum of users, including those who have trouble presenting a pay slip or who work in non-traditional employment setups. MoneyTap uses cutting-edge technology to evaluate applicants’ creditworthiness while taking into account a wide range of variables outside of traditional job records.

The application guarantees an easy-to-use interface, enabling a smooth loan application procedure with prompt approvals and effective disbursements. MoneyTap’s reputation as a trustworthy rapid loan app is cemented by its dedication to openness in terms and conditions and its prompt customer service. In the ever-changing world of rapid loan applications, MoneyTap stands out as a reliable and approachable option for people in need of financial support without the usual wage slip requirements.

15.mPokket (Best Instant Loan App Without Salary Slip)

One notable example of an immediate loan app is mPokket, which has gained popularity due to its unique feature of not requiring a traditional wage slip for the application procedure. This special function serves a wide range of people, such as those with non-traditional work arrangements or those who have trouble supplying a pay stub. mPokket uses cutting edge technology to evaluate applicants’ creditworthiness, taking into account a wide range of variables other than employment histories.

With its user-friendly interface, the app guarantees a quick and easy loan application procedure with timely approvals and payouts. mPokket’s reputation as a trustworthy rapid loan app is strengthened by its dedication to openness in its terms and conditions and its prompt customer service. A convenient and approachable option among instant loan applications, mPokket is ideal for people looking for financial support without having to provide a salary slip.

16.LoanTap

As a top fast lending app, LoanTap has established itself by offering a hassle-free borrowing experience without requiring a standard pay stub. This special feature serves those with different work arrangements or those who have trouble producing a pay stub. With the use of cutting-edge technology, LoanTap assesses applicants’ creditworthiness based on a wide range of factors outside of traditional job histories.

With its intuitive design, the app expedites the loan application process and ensures prompt approvals and efficient payments. LoanTap’s reputation as a trustworthy instant loan app is cemented by its dedication to openness in terms and conditions and its quick customer service system. In the competitive world of rapid loan applications, LoanTap stands out as a reliable and approachable option for individuals in need of financial support without the usual salary slip requirements.

17.EarlySalary

Since it no longer requires a standard pay stub to be submitted with a loan application, EarlySalary has become one of the top fast loan apps. This unique function serves a wide range of users, including those with non-traditional work arrangements or difficulties generating a pay stub. Using cutting-edge technology, EarlySalary evaluates applicants’ creditworthiness based on a wide range of criteria that go beyond traditional job histories.

With its intuitive layout, the app makes it easy to apply for loans and offers fast approvals and quick disbursements. EarlySalary’s reputation as a trustworthy rapid loan app is strengthened by its dedication to openness in its terms and conditions and its prompt customer service. In the constantly changing world of rapid loan applications, EarlySalary stands out as a practical and approachable option for individuals looking for financial aid without the usual pay slip formalities.

18.Fibe

Fibe has become a major force in the Indian consumer lending market, focusing especially on assisting the younger and mid-income groups in realising their dreams. Fibe, one of the top consumer loan applications, is distinguished by its quick financial solutions and quick access to funds up to ₹5 lakhs.

This intuitive platform is made to meet the wide range of financial demands of its users, guaranteeing ease of use and effectiveness in handling different goals and budgetary constraints. Fibe strives to give people the financial flexibility they need to face life’s obstacles, whether that means addressing unforeseen bills or achieving personal objectives.

19.MoneyView

MoneyView bills itself as one of the greatest applications for quick loans, and it stands out in part because it is flexible enough to not require a standard pay stub for the application procedure. This special function serves a broad spectrum of users, including those with non-traditional work arrangements or difficulties providing a pay stub. MoneyView uses sophisticated algorithms to evaluate applicants’ creditworthiness, taking into account a number of variables outside of work records.

With its user-friendly interface, the app expedites the loan application process, resulting in speedy approvals and effective payments. MoneyView’s reputation as a dependable and approachable rapid loan app is strengthened by its dedication to openness in terms and conditions and its prompt customer service. In the ever-changing world of rapid loan applications, MoneyView stands out as a reliable option for people in need of financial support without the usual wage slip requirements.

20.Finnable (Best Instant Loan App Without Salary Slip)

As an instantaneous, paperless personal loan app, Finnable stands out for providing people in need of financial aid with a simple and easy experience. The main advantage of the software is its dedication to a paperless application process, which does away with the requirement for copious documentation. Users find the loan application procedure more accessible and effective as a result of this convenience.

Furthermore, Finnable places a strong emphasis on responsible lending practices, having forged alliances with financial institutions and NBFCs (Non-Banking Financial Companies) subject to RBI regulation. Users can feel secure and dependable knowing that the loan methods comply with regulatory norms thanks to our collaboration. Finnable hopes to provide a user-friendly platform that makes it simple for people to obtain immediate personal loans through its dedication to simplicity and ethical financial partnerships.

21.Privo

Privo sets itself out as an app that falls under the purview of one of India’s leading neo-lending conglomerates, Kisetsu Saison Finance (India) Pvt Ltd, better known as Credit Saison India (CS India). Privo distinguishes itself in the digital lending market by upholding the Reserve Bank of India’s Fair Practice Code and demonstrating a dedication to openness. The app places a high priority on adhering to ethical lending procedures while offering loans to users in a smooth and effective manner.

Privo’s adoption of digital lending is a contribution to the changing fintech scene in India, guaranteeing that consumers can obtain financial aid with confidence in the loan procedure and clarity. By virtue of its affiliation with Credit Saison India and commitment to regulatory compliance, Privo endeavours to provide a dependable digital lending platform while upholding transparency and responsible lending methodologies.

22.LazyPay

Being one of the greatest instant loan applications, LazyPay has made a name for itself by being flexible and easy to use. One of its standout features is that it doesn’t require a typical pay stub to be submitted with the application. This special function serves a wide spectrum of users, including those who have unconventional work arrangements or find it difficult to provide a pay stub. LazyPay uses sophisticated algorithms to evaluate applicants’ creditworthiness, taking into account a number of variables outside of traditional job histories.

The loan application procedure is streamlined by the app, which offers prompt approvals and effective payments. LazyPay’s reputation as a dependable and approachable rapid loan app is cemented by its dedication to openness in terms and conditions and its prompt customer service. In the ever-changing world of immediate loan applications, LazyPay stands out as a reliable option for individuals looking for quick financial aid without the usual income slip requirements.

23.Bajaj Finserv

One of the greatest rapid loan applications is Bajaj Finserv, which stands out for offering a wide variety of financial solutions and for not requiring a standard pay stub in order to apply for a loan. Because of this distinctive feature, Bajaj Finserv is especially attractive to people with different work arrangements or who are having trouble providing a pay stub. Bajaj Finserv uses cutting-edge technology to assess applicants’ creditworthiness using a variety of criteria other than traditional job records.

With its intuitive UI, the app guarantees a smooth loan application procedure with quick approvals and fast disbursements. Bajaj Finserv’s reputation as a trustworthy and user-friendly fast loan app is cemented by its dedication to transparency and strong customer support network. In the competitive world of fast loan applications, Bajaj Finserv stands out as a reliable and practical choice for individuals looking for quick cash support without the usual pay stub restrictions.

24.RupeeRedee

RupeeRedee has established itself as one of the greatest apps for rapid loans thanks to its special ability to apply for loans without requiring a regular pay stub. This distinguishes RupeeRedee and makes it a desirable choice for people with non-traditional work arrangements or who find it challenging to furnish a pay stub. The application makes use of cutting-edge technology to evaluate applicants’ creditworthiness based on a wide range of factors that go beyond traditional work records.

RupeeRedee’s user-friendly design makes it easier to apply for loans, resulting in fast approvals and timely disbursements. RupeeRedee is a more reputable fast loan app because of its dedication to providing clear terms and conditions and prompt customer service. In the ever-changing world of rapid loan applications, RupeeRedee stands out as a dependable and approachable option for people in need of immediate financial aid without the usual wage slip requirements.

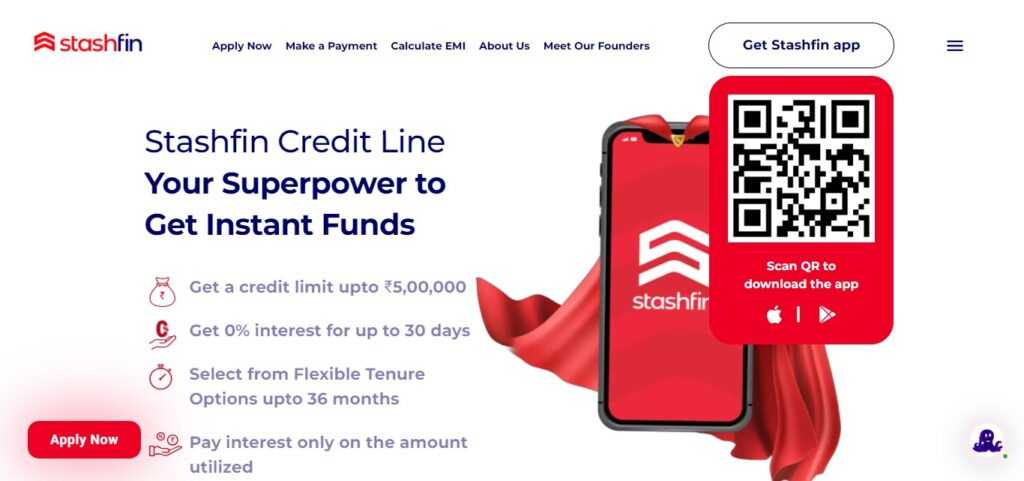

25.StashFin (Best Instant Loan App Without Salary Slip)

Because it doesn’t require a typical pay stub for the application procedure, StashFin has established itself as a top provider of fast loan apps. This function is designed to accommodate people who work in different types of environments or who find it difficult to provide a paystub. Applyers’ creditworthiness is evaluated by StashFin using cutting-edge technology that takes into account a wide range of variables outside of traditional job histories.

With its user-friendly interface, the app expedites the loan application process, resulting in speedy approvals and effective payments. StashFin’s reputation as a trustworthy and user-friendly fast lending app is cemented by its dedication to openness in terms and conditions and its prompt customer service. In the crowded field of rapid loan applications, StashFin stands out as a reliable and practical choice for people in need of financial support without the usual income slip requirements.

26.Credy

Due to its innovative feature of not requiring a standard income slip throughout the loan application process, Credy has become one of the greatest rapid loan applications. This distinguishes Credy and makes it a desirable choice for people with a variety of work arrangements or difficulties submitting a pay stub. Credy evaluates applicants’ creditworthiness using sophisticated algorithms that take into account a number of variables outside of traditional job records. The programme provides an easy-to-use interface that makes the loan application process smooth and effective, resulting in prompt approvals and payouts.

Credy’s reputation as a trustworthy rapid loan app is cemented by its dedication to openness in terms and conditions and its prompt customer service. In the ever changing world of rapid loan applications, Credy stands out as a trustworthy and approachable option for people in need of immediate financial aid without the usual salary slip criteria.

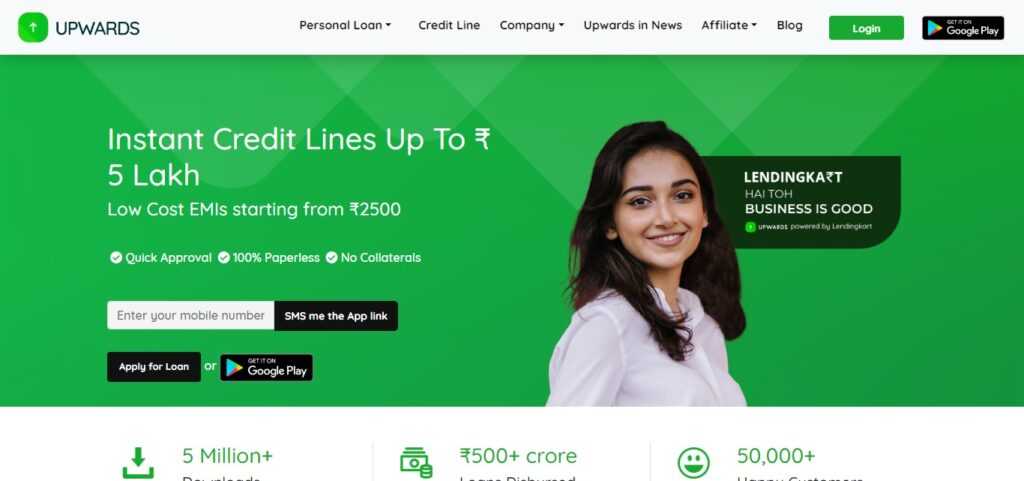

27.Upwards

One of the best rapid loan applications is Upwards, which sets itself apart from the competition by not needing a standard pay stub to be submitted with the loan application. This particular feature accommodates folks who have different work arrangements or who are having trouble supplying a pay stub. Upwards assesses applicants’ creditworthiness using cutting-edge technology and a wide range of factors outside traditional job records.

The programme guarantees an intuitive user interface, expediting the loan application procedure for prompt approvals and payouts. Upwards’s reputation as a dependable and easily accessible rapid loan app is strengthened by its dedication to providing transparent terms and conditions and prompt customer service. In the competitive world of rapid loan applications, Upwards stands out as a dependable and user-centric option for people seeking immediate financial aid without the usual wage slip requirements.

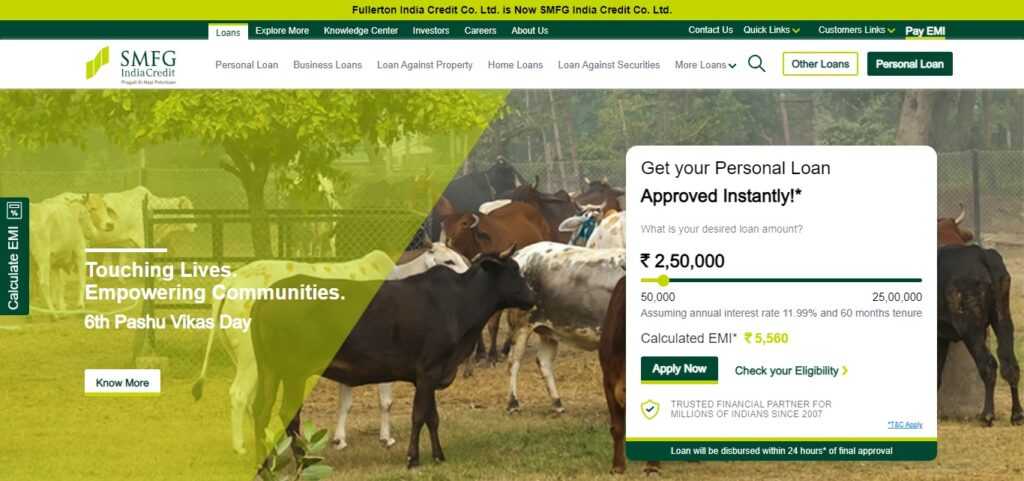

28.SMFG Credit

SMFG Credit has established itself as a significant participant in the fast loan application space, providing a unique benefit by not requiring a standard pay stub at the time of application. This special feature helps those who have different work arrangements or who find it difficult to provide a pay stub. SMFG Credit evaluates applicants’ creditworthiness using sophisticated technology and takes into account a wide range of factors outside of traditional employment histories.

The application guarantees an intuitive user interface, enabling a smooth and effective loan application procedure with prompt approvals and payouts. Reliability as an immediate lending app is enhanced by SMFG Credit’s dedication to clear terms and conditions and prompt customer service. In the rapidly changing world of immediate loan applications, SMFG Credit stands out as a reliable and approachable option for people in need of financial support without the usual wage slip requirements.

29.IDFC First Bank

In India, IDFC First Bank is a well-known financial organisation that offers a wide range of banking and financial services. IDFC First Bank is a customer-centric bank that prioritises offering creative and inclusive solutions to satisfy its clients’ varied financial demands. The bank provides a large range of goods, such as loans, credit cards, fixed deposits, and savings accounts.

IDFC First Bank is dedicated to advancing technology and offers a digital platform that is easy to use, making it convenient for customers to access and manage their accounts. The bank is renowned for emphasising efficiency and openness in its operations and for taking a customer-centric approach. IDFC First Bank’s reputation as a dependable and trustworthy financial institution in the Indian banking industry is a result of its commitment to financial inclusion and providing exceptional customer care.

30.Fullerton India (Best Instant Loan App Without Salary Slip)

Reputable financial company Fullerton India has had a significant impact on the Indian financial scene. Fullerton India serves the various needs of people and companies by concentrating on offering a wide range of financial solutions. The organisation provides a wide range of services, such as wealth management, insurance, and loans.

Fullerton India has gained recognition for its dedication to meeting customer needs by offering accessibility and convenience via an extensive branch and digital platform network. Fullerton India has established itself as a reliable brand in the financial industry thanks to its creative products and customer-focused philosophy, which has greatly aided in financial inclusion and empowerment throughout the nation.

Can You Take A Loan Against FD?

If you need money right away and don’t want to liquidate your fixed deposit (FD), you can get a loan against it. The qualifying loan amount under this arrangement usually equals approximately 75% of the total amount invested in the fixed deposit. This suggests that a person who, for example, has a $10,000 fixed deposit may be eligible for a loan of up to $7,500. Since the fixed deposit acts as collateral and gives the lender security, the procedure is rather simple. Due to the lender’s decreased risk, these loans typically have interest rates that are lower than those of unsecured loans.

By leveraging the fixed deposit’s value while retaining the opportunity to earn interest, this strategy helps people strike a balance between addressing their short-term requirements and building a secure investment portfolio. To make wise judgements and maintain responsible financial management, borrowers must be aware of all the terms and conditions of the loan, including the interest rate and payback schedule.

What Is Look For In Best Instant loan App Without Salary Slip?

It’s important to take into account a number of things when looking for the best rapid loan app that doesn’t demand a pay stub in order to guarantee a trustworthy and open lending experience. These are important things to consider:

Eligibility Criteria: Understanding the app’s eligibility requirements is important. Make sure it accommodates your particular circumstances, such as being user-friendly for independent contractors, self-employed people, or people who don’t have a standard pay stub.

Alternative Income Verification: Verify the alternative income sources that the app accepts by going to the Alternative Income Verification page. Bank statements, tax records, and other evidence of income can be used to support this. For people who do not have a traditional pay stub, a flexible method of income verification is necessary.

Speed of Approval and payout: Quick loan apps have the benefit of quick approval and payout. Seek for applications with fast processing speeds to make sure you can get your money quickly when you need it.

Flexibility and Repayment Terms: Be aware of any flexibility in the repayment schedules as well as the loan tenure. Certain apps might provide possibilities for early payback at no extra cost.

Security and privacy: To safeguard your money and personal information, be sure the app complies with strict security protocols. Verify that encryption mechanisms are being used and that data protection requirements are being followed.

Conclusion Best Instant loan App Without Salary Slip

In conclusion, people in non-traditional employment situations may find it wise to choose the best rapid loan app that doesn’t require a pay stub. With the use of alternative income verification techniques, these inclusive apps enable self-employed people, freelancers, and gig workers to obtain loans quickly and easily. The app’s eligibility requirements, alternate methods of confirming income, loan amount, interest rates, approval and disbursement times, conditions of repayment, security measures, user feedback, and regulatory compliance are important things to take into account.

Borrowers can select an app that not only fulfils their urgent financial demands but also offers a transparent and trustworthy loan experience by carefully evaluating these factors. For a responsible and successful borrowing experience, people must prioritise data protection, be informed about the terms and circumstances of the loan, and choose an app that fits their particular financial situation.

FAQ Best Instant loan App Without Salary Slip

Can I apply for an instant loan without a salary slip?

Yes, many instant loan apps cater to individuals without a salary slip. They often use alternative data sources to assess creditworthiness, making the process inclusive for freelancers, gig workers, and self-employed individuals.

How much loan amount can I expect without a salary slip?

The eligible loan amount is typically around 75% of the fixed deposit amount or based on alternative income verification. The exact percentage may vary between different loan apps.

What documentation is required to apply for a loan without a salary slip?

While salary slips are not mandatory, you may need to provide alternative documents such as bank statements, tax returns, or proof of income from other sources. The exact requirements vary among different loan apps.

How quickly can I get approval and disbursement with these apps?

Instant loan apps prioritize quick processes. Once you submit the required documents, approval and disbursement timelines can vary, but many aim for rapid turnaround times, sometimes within a few hours.

Are the interest rates higher for loans without a salary slip?

Interest rates can vary between loan apps. In some cases, loans secured against collateral like a fixed deposit may have lower interest rates compared to unsecured loans. It’s important to review and compare rates before choosing an app.