Best Crypto Tax Software: The top crypto tax software provides individuals and businesses with an accessible solution for navigating the complexities of cryptocurrency taxation. It simplifies calculations of tax liabilities, tracking transactions, and creating tax reports. Supports multiple cryptocurrencies and offers current tax regulations and guidance to ensure compliance.

With features that allow investors to import data from multiple exchanges and wallets, as well as various tax calculation methods available, Crypto Investor Suite caters to the diverse needs of crypto investors. Additionally, this solution prioritizes security by protecting sensitive financial information while equipping users with tools needed to accurately report crypto gains and losses, making tax season less daunting for those working within this space.

Why Choose Best Crypto Tax Software?

Selecting an ideal crypto tax software provides several key benefits for individuals and businesses involved in cryptocurrency transactions. First, it streamlines the often complex and time-consuming process of calculating cryptocurrency tax liabilities; automated tracking capabilities simplify tracking transactions while accurately computing taxable gains/losses to reduce errors and reduce risk.

Additionally, the best cryptocurrency tax software provides up-to-date tax regulations and guidance, helping users remain compliant with emerging cryptocurrency tax laws. This is especially essential as tax authorities around the world become increasingly focused on cryptocurrency tax compliance. This software’s ability to support various cryptocurrencies and aggregate data from multiple exchanges and wallets make it an adaptable solution that meets the diverse needs of crypto investors.

- Advertisement -

Data security is of utmost importance in the crypto space, and top tax software prioritizes protecting sensitive financial information to provide a secure environment for managing financial information. Selecting a top crypto tax software will significantly ease the burden of reporting taxes, improve compliance, and simplify record-keeping – ultimately making cryptocurrency taxation much less daunting and daunting for users.

Best Crypto Tax Software

- Crypto.com Tax

- ZenLedger

- CoinTracker

- BitcoinTaxes

- Accointing.com

- Blockpit

- CoinLedger

- CoinTracking

- TokenTax

- CryptoTaxCalculator

- TaxBit

- Cointelli

- Koinly

- Coinpanda

- CryptoTrader.Tax

15 Best Crypto Tax Software

1. Crypto.com Tax (Best Crypto Tax Software)

Crypto.com Tax is an intuitive cryptocurrency tax software solution designed to make calculating and reporting crypto tax liabilities much simpler. This software streamlines cryptocurrency transaction tracking and accurately calculates tax compliance by tracking taxable gains and losses more efficiently and reducing errors to ensure tax compliance. Support for various cryptocurrencies and the ability to import data from different exchanges and wallets makes this tool perfect for crypto investors of all stripes.

Crypto.com Tax provides users with up-to-date tax regulations and guidance, helping them confidently navigate the ever-evolving crypto tax landscape. Security is of the utmost importance; Crypto.com Tax protects sensitive financial data to ensure user privacy. Overall, Crypto.com Tax serves as an indispensable tool for cryptocurrency enthusiasts and investors looking for an easy yet secure way to fulfill their crypto tax obligations.

2. ZenLedger

ZenLedger is an easy and user-friendly cryptocurrency tax software designed to streamline cryptocurrency taxation for individuals and businesses alike. This comprehensive solution offers efficient tax calculation as well as accurate reports. ZenLedger provides investors with an all-encompassing cryptocurrency management solution, capable of importing data from a diverse selection of exchanges and wallets.

As such, ZenLedger meets the diverse needs of crypto investors alike. ZenLedger keeps users up-to-date with the most up-to-date tax regulations and offers essential guidance, ensuring compliance with a rapidly changing regulatory environment. In addition, its emphasis on data security prioritizes protecting sensitive financial information – making tax season less daunting and more manageable for cryptocurrency taxpayers alike.

3. CoinTracker

CoinTracker is an award-winning cryptocurrency tax software solution, providing users with an accessible interface for managing cryptocurrency tax obligations. Tax Liabilities and Track Transactions is an indispensable resource for individuals and businesses involved in crypto. CoinTracker supports an expansive range of cryptocurrencies and seamlessly synchronizes data from exchanges and wallets – meeting the diverse needs of investors across various cryptocurrency asset classes.

Furthermore, it offers up-to-date tax regulations to facilitate compliance with evolving cryptocurrency tax regulations. Security is of utmost importance and CoinTracker takes comprehensive steps to safeguard sensitive financial data for its users’ peace of mind. Overall, CoinTracker serves as an indispensable resource for simplifying cryptocurrency tax reporting and keeping abreast of an ever-evolving tax landscape.

4. BitcoinTaxes

BitcoinTaxes is a reliable and user-friendly cryptocurrency tax software solution, designed to make taxation of cryptocurrency easier. This platform provides a simple, user-friendly solution for individuals and businesses to calculate tax liabilities accurately, generate accurate reports and stay compliant. Supports an expansive range of cryptocurrencies and provides easy data import from exchanges and wallets – meeting all the diverse needs of crypto investors.

BitcoinTaxes keeps users informed on the most up-to-date tax regulations, offering essential guidance that enables them to remain compliant in an ever-evolving cryptocurrency tax world. Security is of utmost importance; with comprehensive measures taken to protect sensitive financial data. In essence, BitcoinTaxes serves as an indispensable aid in making cryptocurrency tax reporting less daunting and daunting for anyone navigating its challenges.

5. Accointing.com (Best Crypto Tax Software)

Accointing.com is an advanced yet user-friendly cryptocurrency tax software designed to make fulfilling tax obligations simpler. This platform provides an effortless user experience for individuals and businesses seeking to calculate tax liabilities, track transactions and generate accurate tax reports. Its support of various cryptocurrencies and ability to seamlessly incorporate data from multiple exchanges and wallets makes it suitable for different types of crypto investors.

Accointing.com also provides up-to-date tax regulations and guidance, so users remain compliant with ever-evolving cryptocurrency tax laws. Security is of utmost importance; stringent measures have been put in place to protect sensitive financial data. Ultimately, Accointing.com serves as an invaluable tool for navigating the complexities of cryptocurrency tax reporting – helping users stay compliant while decreasing any challenges related to cryptocurrency taxation.

6. Blockpit

Blockpit is a user-friendly cryptocurrency tax software designed to streamline the complex process of fulfilling cryptocurrency tax obligations. This platform offers an effortless experience for individuals and businesses seeking to calculate tax liabilities, track transactions and produce accurate reports. Blockpit provides support for multiple cryptocurrencies and the ability to import data from various exchanges and wallets, meeting the diverse needs of crypto investors.

Blockpit offers up-to-date tax regulations and guidance to keep up with cryptocurrency tax laws as they evolve, while its emphasis on security makes reporting simpler for users. Security is of utmost importance; therefore, robust measures have been put in place to protect sensitive financial data. As an essential tool for simplifying cryptocurrency tax reporting processes and making them less daunting for them, Blockpit serves as an indispensable aide in this regard.

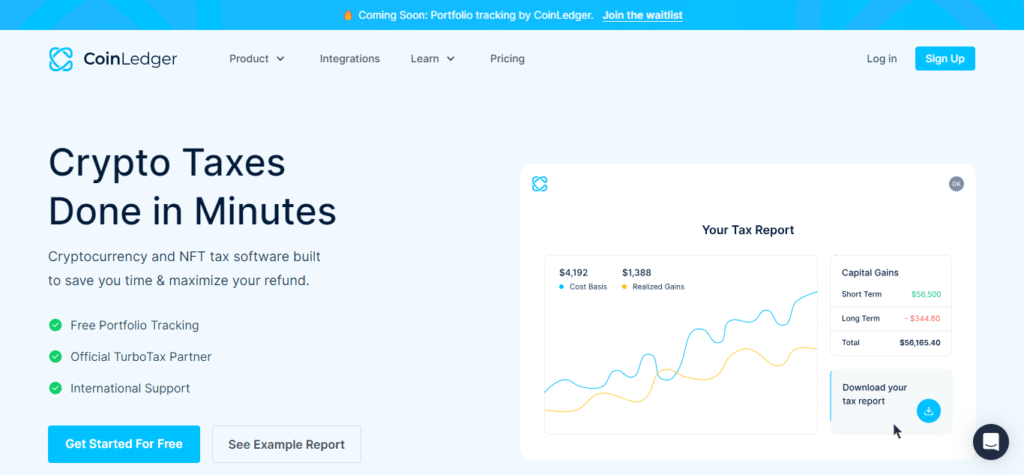

7. CoinLedger

CoinLedger is a user-friendly cryptocurrency tax software designed to make the complex nature of cryptocurrency taxation simple and accessible. This platform provides individuals and businesses alike with a convenient experience, streamlining the calculation of tax liabilities, transaction tracking, and accurate report generation. CoinLedger supports multiple cryptocurrencies and seamlessly ties together data from different exchanges and wallets, making it tailored to meet the diverse needs of cryptocurrency investors.

CoinLedger software ensures users remain compliant with current tax regulations, providing essential guidance for navigating the ever-evolving cryptocurrency tax landscape. Security is of utmost importance, with stringent measures in place to protect sensitive financial data. Essentially, CoinLedger serves as an indispensable resource for those aiming to streamline cryptocurrency tax reporting – making the task less daunting and more manageable.

8. CoinTracking

CoinTracking is a robust yet user-friendly cryptocurrency tax software solution designed to streamline cryptocurrency taxation for both individuals and businesses alike. This platform provides an effortless way of calculating tax liabilities, tracking transactions, and creating precise reports. CoinTracking supports an expansive selection of cryptocurrencies and seamlessly imports data from multiple exchanges and wallets – meeting the varying needs of crypto investors.

With access to up-to-date tax regulations and essential guidance, CoinTracking ensures users remain compliant with ever-evolving cryptocurrency tax laws. Security is of utmost importance with stringent measures in place to protect sensitive financial data. Ultimately, CoinTracking is an invaluable tool that makes tax reporting an easier, less daunting process for users.

9. TokenTax

TokenTax is an intuitive cryptocurrency tax software solution, designed to ease the complex task of complying with tax obligations for cryptocurrency assets. This platform offers an easy way for individuals and businesses to calculate tax liabilities, track transactions, and generate accurate tax reports. TokenTax supports multiple cryptocurrencies and integrates data from numerous exchanges and wallets seamlessly, making it suitable for various types of crypto investors.

TokenTax also provides up-to-date tax regulations and essential guidance to ensure users remain compliant with ever-evolving cryptocurrency tax laws. Security is of utmost importance; TokenTax features stringent measures in place to safeguard sensitive financial information. Ultimately, TokenTax is an invaluable tool that makes cryptocurrency tax reporting a much less daunting and complex experience for users.

10. CryptoTaxCalculator (Best Crypto Tax Software)

CryptoTaxCalculator is an accessible cryptocurrency tax software solution designed to take away some of the complexity associated with cryptocurrency taxation. This platform provides an efficient and user-friendly experience for individuals and businesses looking to calculate tax liabilities, track transactions, and produce accurate reports. CryptoTaxCalculator supports multiple cryptocurrencies and allows easy data import from exchanges and wallets – making it suitable for different types of crypto investors.

CryptoTaxCalculator keeps users abreast of the latest tax regulations and provides essential guidance to ensure compliance with ever-evolving cryptocurrency tax laws. Data security is prioritized with stringent measures in place to safeguard sensitive financial information. In sum, CryptoTaxCalculator is an invaluable tool that simplifies cryptocurrency tax reporting processes for users making it a much less cumbersome and daunting experience.

11. TaxBit

TaxBit is an all-encompassing and user-friendly cryptocurrency tax software solution, designed to ease the complex task of meeting cryptocurrency tax obligations. This platform provides an accessible and user-friendly experience for individuals and businesses seeking to calculate tax liabilities, track transactions, and generate accurate tax reports. TaxBit supports an expansive list of cryptocurrencies and allows easy data import from exchanges and wallets – making it suitable for different types of crypto investors.

TaxBit keeps users up-to-date with the most up-to-date cryptocurrency tax laws, providing essential guidance to ensure compliance. Data security is of top priority with stringent measures in place to protect sensitive financial information. Overall, TaxBit provides an indispensable service that makes cryptocurrency tax reporting simpler for users – making the reporting process less daunting and manageable overall.

12. Cointelli

Cointelli is an intuitive cryptocurrency tax software solution, providing users with all of the information needed to navigate the complex world of crypto taxation. This platform provides an effortless experience for individuals and businesses seeking to calculate tax liabilities, monitor transactions, and produce accurate tax reports. Cointelli provides support for multiple cryptocurrencies and seamlessly synchronizes data from different exchanges and wallets to meet the diverse needs of crypto investors.

Cointelli keeps up-to-date on the most up-to-date cryptocurrency tax regulations and provides essential guidance to users, helping ensure compliance with ever-evolving cryptocurrency tax laws. Data security is taken extremely seriously with comprehensive measures put in place to safeguard sensitive financial data. In all, Cointelli serves as an indispensable resource to simplify cryptocurrency tax reporting for users by making it an easier, less daunting experience.

13. Koinly

Koinly is an intuitive cryptocurrency tax software solution that makes cryptocurrency taxation straightforward for individuals and businesses alike. This platform enables individuals and companies to calculate tax liabilities accurately, track transactions efficiently, and produce detailed tax reports with ease. Koinly offers support for an extensive array of cryptocurrencies and seamlessly imports data from multiple exchanges and wallets, meeting the varying needs of crypto investors.

Koinly provides users with up-to-date tax regulations and essential guidance, enabling them to remain compliant with cryptocurrency tax laws as they change. Security is of utmost importance; stringent measures have been put in place to protect sensitive financial data. In sum, it’s an invaluable tool that makes cryptocurrency tax reporting simpler for users while making tax filing a less daunting process overall.

14. Coinpanda

Coinpanda is an intuitive cryptocurrency tax software solution that makes cryptocurrency taxation straightforward. This platform offers an efficient solution for both individuals and businesses seeking to calculate tax liabilities, track transactions and produce accurate tax reports. Coinpanda offers comprehensive support for an array of cryptocurrencies and seamlessly synchronizes information from various exchanges and wallets – catering to the specific requirements of crypto investors.

Coinpanda provides users with essential guidance to remain compliant in an ever-evolving cryptocurrency tax landscape, keeping users up-to-date on tax regulations while protecting sensitive financial data. Security is of the utmost importance with robust measures in place to secure this sensitive financial data. Overall, Coinpanda serves as an indispensable resource to simplify cryptocurrency tax reporting for users making it more manageable and less intimidating process for reporting.

15. CryptoTrader.Tax (Best Crypto Tax Software)

CryptoTrader.Tax is an intuitive cryptocurrency tax software solution, designed to make taxation of cryptocurrencies less complex and confusing for its users. This platform offers an intuitive experience to individuals and businesses seeking to calculate tax liabilities, track transactions and create accurate tax reports. CryptoTrader.Tax supports an expansive variety of cryptocurrencies and allows easy data import from different exchanges and wallets, making it suitable for various types of crypto investors.

CryptoTrader.Tax keeps users abreast of the most up-to-date tax regulations, providing essential guidance to ensure compliance with ever-evolving cryptocurrency tax laws. Data security is prioritized, with stringent measures implemented to safeguard sensitive financial information. All-in-all, CryptoTrader.Tax provides users with an invaluable tool to streamline cryptocurrency tax reporting in a more manageable and less stressful fashion.

Best Crypto Tax Software Features

Automatic Data Import: Ideally, software should allow users to automatically import their cryptocurrency transaction data from various exchanges and wallets – eliminating the need for manual data entry.

Comprehensive Cryptocurrency Support: For optimal portfolio diversification, your platform should support an array of cryptocurrencies.

Real-Time Tax Calculations: A good financial software should provide real-time calculations of tax liabilities based on current laws, enabling users to make informed financial decisions.

Tax Reporting: For accurate tax filings, software should produce accurate reports highlighting capital gains/losses, income and transaction histories that can easily be integrated into tax filings.

Tax-Loss Harvesting: Certain platforms provide insight into tax loss harvesting opportunities to minimize tax liabilities and optimize tax obligations.

Support for Multiple Jurisdictions: It must take into account the tax regulations in various countries or states.

Tax Forms: For maximum usability, software should provide support for popular tax forms like IRS Form 8949 in the US.

Tax Saving Suggestions: Some software offers advice to reduce tax obligations.

Customer Support and Access to Tax Experts: Having reliable customer support and access to tax experts can be extremely useful for users needing assistance.

Integrating Accounting Software: Integrating accounting software such as QuickBooks can simplify financial reporting for businesses.

Best Crypto Tax Software Pros & Cons

Pros of using crypto tax software:

Efficiency: These tools automate the tax reporting process, saving both time and minimizing risks associated with manual calculations.

Accuracy: Crypto tax software offers accurate calculations based on real-time data and tax regulations, helping ensure compliance with tax laws.

Convenience: Users can import data from multiple exchanges and wallets easily, streamlining record keeping.

Tax Optimization: Some software provides strategies and advice designed to minimize users’ tax liabilities and liabilities.

Comprehensive Reporting: With these tools, it is easier than ever to prepare comprehensive tax reports, making filing taxes and maintaining an audit trail simpler than ever before.

Multiple Cost Basis Methods: Users have multiple cost basis calculation methods at their disposal to optimize their tax obligations, such as FIFO and LIFO, according to their needs.

Cross-Jurisdiction Support: Many crypto tax software solutions accommodate for the tax regulations in multiple countries or states, making them suitable for an international user base.

Cons of using crypto tax software:

Cost: Many crypto tax software options come at a price, which may present difficulties for users looking to reduce expenses.

Learning Curve: Users with complex portfolios may need to take some time learning how to utilize the software effectively.

Data Import Challenges: In spite of our best efforts to make data import seamless, users may experience issues when trying to access certain exchanges or wallets that aren’t supported by our software.

Privacy Concerns: Sharing sensitive financial data with third-party software providers may present certain privacy risks, particularly within the cryptocurrency industry.

Technical Issues: Like any software application, crypto tax tools may experience occasional technical glitches or compatibility issues that require adjustments or updates.

Updates Are Necessary: Users should stay abreast of changes to tax laws and regulations, which may necessitate ongoing updates of software to remain compliant.

Lack of Real-Time Data: Accuracy of Software Depends on Up-To-Date Information: Accuracy is dependent upon timely updates to data updates; otherwise it could lag behind real time market fluctuations and provide inaccurate results.

Best Crypto Tax Software Conclusion

The best crypto tax software serves as an invaluable resource for both individuals and businesses navigating the complexities of cryptocurrency taxation. These solutions offer efficiency, accuracy, and convenience by automating calculations of tax liabilities as well as reporting them. Tax preparation services produce comprehensive tax reports, support a range of cryptocurrencies, and often offer tax optimization strategies that allow users to minimize their tax obligations.

However, these tools come with associated costs, may involve an initial learning curve and present privacy concerns regarding sensitive financial data. For optimal use of crypto tax software, users must carefully consider their individual needs and preferences when choosing a platform to fit with their portfolio and regulatory needs. Crypto tax platforms are invaluable tools that simplify an otherwise difficult aspect of investing while assuring compliance with ever-evolving tax regulations.

Best Crypto Tax Software FAQ’s

What is Crypto Tax Software, and Why Am I Needing it?

Crypto tax software is a tool designed to assist individuals and businesses calculate and report cryptocurrency tax liabilities accurately and quickly. By simplifying the process and complying with tax regulations while accurately recording crypto gains and losses.

How Does Crypto Tax Software Work?

Crypto tax software works by collecting your transaction data from cryptocurrency exchanges and wallets, then applying any applicable tax rules before calculating taxable gains and losses using one of two methods (FIFO or LIFO).

What are the Cost Implications of Crypto Tax Software?

Crypto tax software varies greatly in cost depending on its provider and features; free versions with limited functionality can sometimes be found, while others require one-time purchases or subscription fees for their use. When selecting software it is important that users consider both their budget and needs when selecting suitable solutions.

Can cryptocurrency tax software handle various cryptocurrencies and exchanges?

Most crypto tax software provides support for an extensive list of cryptocurrencies and import data from multiple exchanges and wallets; therefore it’s crucial that you select software which meets the needs of your particular portfolio.

How can I ensure data security when using crypto tax software?

To protect the confidentiality of sensitive information, select only reputable crypto tax providers with strong security measures that include encryption and data protection. It is wise not to share sensitive details with unverified or unknown software.

What is the Best Method of Calculating Crypto Taxes: FIFO or LIFO?

Your best choice in calculating cryptocurrency taxes depends upon your unique circumstances and goals. While FIFO (First-In, First-Out) is commonly employed and aligns with traditional tax principles, LIFO may help minimize short-term capital gains and can even help minimize short-term tax gains – consult a tax professional if unsure.

Do I still require professional advice when using crypto tax software?

While crypto tax software can make the process easier, if your crypto portfolio or tax issues are complex or unique it would still be wise to consult a tax professional as they provide expert advice while ensuring compliance with tax laws.

Are updates for crypto tax software necessary?

Updates of crypto tax software are necessary in order to stay compliant with changing tax laws and regulations, so users must stay up-to-date with any necessary updates and apply them as necessary.

Can crypto tax software help me with international tax reporting?

Crypto tax solutions often include support for multiple jurisdictions and can be used for international tax reporting; just make sure it adheres to any relevant tax regulations in each of those countries.

What documents must I keep when using crypto tax software?

It is essential that records of your cryptocurrency transactions be maintained, including buy/sell orders, wallet addresses and tax reports generated by the software. Such records could prove invaluable should an audit occur.